The North Carolina Office of the Commissioner of Banks closed struggling Waccamaw Bank, Whiteville, NC, after the Bank was unable to raise additional capital. The FDIC, as receiver, sold the failed bank to First Community Bank, Bluefield, VA.

Waccamaw Bank, established in 1997, had been desperately trying to raise additional capital to offset losses from nonperforming loans. In a press release, Waccamaw Bank had this to say:

“During the last two years, Waccamaw Bank has been aggressively writing down weakened, real-estate-related loans, reducing expenses and increasing productivity. This has in most cases addressed the new banking standards set by federal regulators and created a stronger bank. Despite its valiant efforts to restore its capital ratios, Waccamaw Bankshares has lost its hard fought struggle to maintain ownership of the Bank despite unyielding market conditions and a harsh industry environment.”

Waccamaw had 16 branches, all of which will reopen on Monday as branches of First Community Bank. All depositors of Waccamaw will automatically become depositors of First Community and all deposits will continue to be insured by the FDIC up to the applicable limits. Over the weekend, depositors of Waccamaw will have access to their money through the use of checks, ATMs and debit cards.

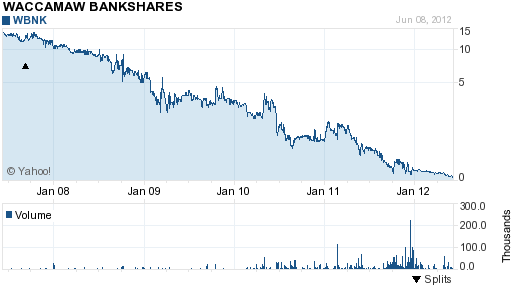

The holding company for Waccamaw Bank is Waccamaw Bankshares, Inc., which is publicly traded. After trading in the $15 per share range in 2006, Waccamaw Banshares began a steady decline with the stock closing at $0.07 at Friday’s closing price.

As of March 31, 2012, Waccamaw Bank had total assets of $533.1 million and total deposits of $472.7 million. First Community Bank agreed to purchase $515.3 million of the failed bank’s assets, leaving the FDIC stuck with the balance of $17.8 million of bad loans. First Community Bank will be partially protected against losses on the asset pool purchased due to a loss-share transaction with the FDIC that covers $330.6 million of the assets purchased.

The use of a loss-share agreement allows the FDIC to more easily sell a failed bank since the losses for an acquiring bank are limited. In addition, the FDIC maintains that by keeping failed bank assets in the private sector, returns are maximized with limited disruption to loan customers.

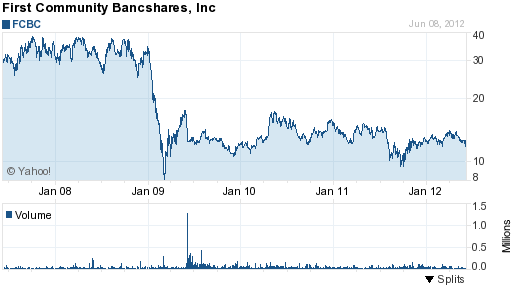

The parent company of First Community Bank is First Community Bancshares, Inc., a publicly traded holding company with over $2.2 billion in assets and 56 offices in four states. First Community Bancshares has been profitable for the past two years but the share price has still not recovered from the financial crisis with the stock selling for less than half the 2008 price.

Courtesy yahoo finance

The loss to the FDIC Deposit Insurance Fund for the failure of Waccamaw Bank is $51.1 million. Waccamaw Bank is the 28th bank failure of the year and the first in North Carolina.

As an investor purchasing bankshares with Waccamaw Bank I was told by Waccamaw Bank employee Freda Gore that this was a strong & sound bank with no worries. This was just prior to the failed bank. We were lied to. She actually talked us into buying more shares. We wanted to represent our local bank which is why we invested in the bank. I feel that the bank knew way in advance that they were failing, but made no indication to the public of their intent therefore leaving all bankshare holding the bag. This is the second time there has been a Waccamaw Bank and they need not come back a third time because everyone now know they are nothing but loosers. WHERE IS OUR MONEY. The shareholders is the ones which kept the back going in the first place. An uneducated person would know not to open 16 banks when you couldn’t keep JUST ONE operating. POOR LEADERSHIP!!!!!!!!