Second Federal Savings and Loan Association of Chicago, Chicago, IL, was closed today by the Officer of the Comptroller of the Currency. The FDIC, appointed as receiver, sold the failed bank to Hinsdale Bank & Trust Company, Hinsdale, IL.

All three branches of Second Federal will reopen on Saturday as branches of Hinsdale Bank & Trust Co and all depositors of the failed bank will automatically become depositors of the acquiring bank. FDIC deposit insurance coverage will continue without interruption up to the applicable limits. All customers of Second Federal Savings and Loan will have access to their money over the weekend through the use of checks, ATM and debit cards.

At March 31, 2012, Second Federal Savings and Loan had total assets of $199.1 million and total deposits of $175.9 million. Hinsdale Bank will pay the FDIC a premium on $100,000 to assume the failed bank’s deposits.

In a very atypical, although not unprecedented move, the FDIC was unable to sell the failed bank’s assets to Hinsdale Bank & Trust. Typically, the FDIC enters into a loss-share agreement with the acquiring bank under which it agrees to absorb a certain amount of the losses on the failed bank’s loan portfolio as an incentive for an acquiring bank. In this case, the loan portfolio was apparently of such low quality that Hinsdale Bank simply refused to buy the assets regardless of what amount of losses the FDIC was offering to reimburse.

The assets of the failed bank will be retained by the FDIC, classified as resolution receivables, and held for later disposition. The FDIC now has nearly $30 billion dollars of junk assets that they need to dispose of (see The FDIC Has A $30 Billion Junk Loan Problem).

Wintrust Financial Corporation, the holding company for Hinsdale Bank & Trust, which has previously purchased numerous failed banks was delighted to pick up almost $200 million in deposits for a mere $100,000. Edward Wehmer, President and CEO of Wintrust said “This FDIC-assisted transaction provides a wonderful opportunity to expand our presence to the vibrant Brighton Park and Little Village neighborhoods of Chicago, as well as Cicero. With our recent announcement of a Chicago Loop location opening and this transaction, we continue on our path to become Chicago’s Bank.”

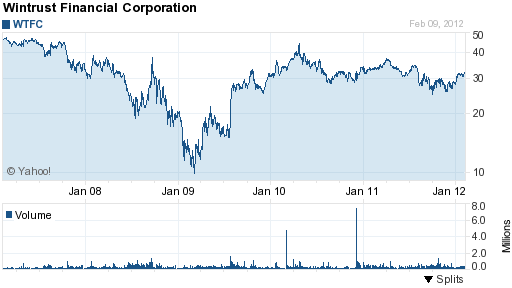

Wintrust Financial Corp has assets of over $16 billion, is profitable and well capitalized. The stock of Wintrust has regained nearly all of its losses since the financial crisis of 2008.

The loss to the FDIC for this banking failure is $76.9 million. Second Federal Savings and Loan Association of Chicago is the nation’s 38th banking failure and the fifth in Chicago.

Speak Your Mind

You must be logged in to post a comment.