August 6, 2010 – Ravenswood Bank, Chicago, Illinois, was closed today by the Illinois Department of Financial and Professional Regulation – Division of Banking. The FDIC was appointed as receiver and entered into an agreement with Northbrook Bank and Trust Company, Northbrook, Illinois, to take over the failed bank.

All deposits of failed Ravenswood Bank will be assumed by Northbrook Bank, a subsidiary of Wintrust Financial Corp of Lake Forest, Illinois. All depositors of failed Ravenswood will automatically become depositors of Northbrook Bank. The two branches of Ravenswood will be open for business on Saturday and depositors will have uninterrupted access to their checking, ATM and debit cards.

The failure of Ravenswood Bank was the 109th banking failure of the year. Illinois has now had a total of 13 banking failures, second only to Florida with 20 bank closings. The failure of Ravenswood Bank is expected to cost the FDIC $68.1 million.

The majority of banking failures this year have been smaller banks which are still reeling from nonperforming home mortgages and commercial real estate. While the largest banks have been able to raise capital, many smaller banks are unable to and remain critically short of capital. In order to protect depositors, regulators have no choice but to close critically undercapitalized banks.

Although the FDIC sees some improvement in the overall health of the banking system, this is subject to a sustained economic recovery. Today’s discouraging unemployment figures indicate that the recovery is still tentative, with many analysts expecting another recession next year. An economic slowdown would result in even higher unemployment and increased loan defaults.

To date, there has been no improvement in the number of Problem Banks.

As of the latest report released by the FDIC there were 775 problem banks at March 31, 2010 up from 702 at the end of 2009. Total assets held by the troubled institutions is $431.2 billion, up from $402.8 billion at the end of 2009.

The historic low for the Problem Bank List was reached in the third quarter of 2006 with 47 banks. The FDIC’s Problem Bank List of 775 banks is the largest number since June 30, 1993.

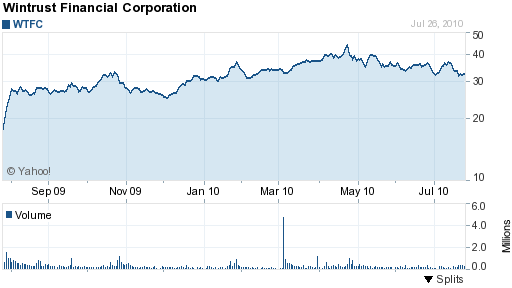

Ravenswood Bank had $264.6 million in total assets and $269.5 million in total deposits as of June 30, 2010. The FDIC will receive a premium of .90 percent from Northbrook for Ravenswood’s deposits. The FDIC also received a Value Appreciation Instrument (VAI) from Wintrust Financial which gives the FDIC an option to exercise 125,000 VAI units until February 2, 2011. The potential profit to the FDIC, based on the performance of Wintrust’s stock, could amount to $1 million.

Northbrook also agreed to purchase all the assets of Ravenswood, subject to a loss-share agreement with the FDIC on $161.3 million of the assets. The loss-share agreement limits potential future losses to Northbrook. The FDIC expects to minimize losses on failed bank assets by keeping them in the private sector.

Northbrook Bank is a wholly-owned subsidiary of Wintrust Financial Corp, a financial holding company with over $13 billion in assets. Wintrust is a major bank in the Chicago area with fifteen community bank subsidiaries. Wintrust also has non-bank subsidiaries operating in commercial insurance, accounts receivable financing and wealth management services. Wintrust had previously acquired failed Lincoln Park Savings in April 2010.

Ed Wehmer, President and CEO of Wintrust commented that “This transaction further complements our strategy of expansion into the city of Chicago and adds a suburban location in Mount Prospect, a market in which we previously did not have a physical presence. The Company now has five locations on the north-side of Chicago as a result of this acquisition and the previous FDIC-assisted acquisition of Lincoln Park Savings Bank in April of this year”.

Wintrust Financial’s latest second quarter results at June 30 showed net income of $13 million ($.25 cents per share) compared to $6.5 million a year ago. Results were below analysts estimates of $.38 cents per share due to an increase in charge offs and bad debt provisions.

WTFC - Courtesy Yahoo Finance

we were never informed that the bank was closing. we have been stock holders for years..nor were we ever informed or notified of any stockholder meetings….does this mean our stock now has no value or are we now strockholders in the NORTHBROOK BANK….PLEASE ADVISE…..

Shareholders almost never see a recovery in a failed bank, are last on the list for claims payment and the stock is usually worthless.

According to the FDIC:

All shares of Ravenswood Bank were owned by its holding company, CBR Holdings, Inc., Chicago, IL. The holding company was not included in the closing of the bank or the resulting receivership. If you are a shareholder of the holding company, please do not contact or file a claim with the receiver. You may contact CBR Holdings, Inc. directly for information as follows:

CBR Holdings, Inc.

2300 West Lawrence Avenue

Chicago, IL 60625

1-773-907-8100

In accordance with Federal law, allowed claims will be paid, after administrative expenses, in the following order of priority:

1.Depositors

2.General Unsecured Creditors

3.Subordinated Debt

4.Stockholders

Calling Ravenswood Bank at the number provided by the FDIC proved worthless. They were very rude, and offered no information whatsoever.

The main issue I’m rearching is how to take a capital loss on the worthless stock. Any ideas?

Thanks.

You can report the capital loss on Schedule D when filing your 2011 tax return.