Plantation Federal Bank, Pawleys Island, South Carolina, was closed today by the Office of the Comptroller of the Currency. The FDIC, acting as receiver, sold the failed bank to First Federal Bank of Charleston, South Carolina.

Plantation Federal Bank, Pawleys Island, South Carolina, was closed today by the Office of the Comptroller of the Currency. The FDIC, acting as receiver, sold the failed bank to First Federal Bank of Charleston, South Carolina.

Plantation Federal Bank, locally owned and operated, had been in business for over seventeen years. The Bank prided itself on being a “community grown” financial institution, deeply involved in the local community.

At the time of its failure, Plantation Federal had expanded into a six branch bank with almost half a billion dollars in assets. Plantation Federal Bank had been under regulatory scrutiny since 2010 when the Bank was issued a cease and desist order for operating in an “unsafe and unsound” manner.

The amount of defaulting loans at Plantation steadily increased each year since 2009. As of the end of last year, Plantation Federal Bank had a ridiculously high troubled asset ratio of 463%. Almost without exception, once a bank’s troubled asset ratio exceeds 100%, the bank winds up being closed by regulators.

All six branches of Plantation Bank will reopen on Monday as branches of First Federal Bank and all depositors of Plantation will automatically becomes depositors of First Federal Bank. FDIC deposit insurance will continue uninterrupted up to the applicable limits. Customers of Plantation Bank will have access to their money over the weekend through the use of checking, ATMs and debit cards.

At the end of last year, Plantation Federal Bank had total assets of $486.4 million and total deposits of $440.5 million. First Federal Bank agreed to buy all of the assets of Plantation Bank. Potential future losses on the asset pool acquired by First Federal will be shared with the FDIC subject to a loss-share transaction between the two parties which covers $221.7 million of the assets purchased. The FDIC expects that losses on the failed Bank’s assets will be minimized by keeping the loans in the private sector and minimizing disruption to loan customers.

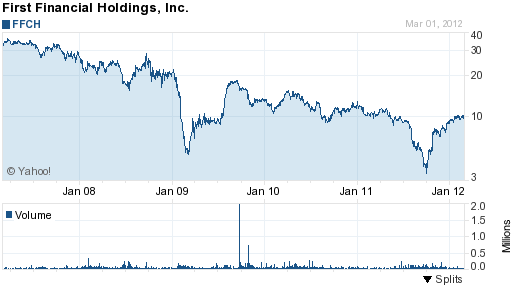

First Federal Bank is owned by holding company First Financial Holdings, Inc. (FFCH), the third largest financial institution in South Carolina based on total assets of over $3.2 billion. The value of First Financial Holdings common stock has more than doubled since late last year.

Courtesy: yahoo finance

The estimated loss to the FDIC Deposit Insurance Fund for the failure of Plantation Federal is $76.0 million. Plantation Federal Bank is the nation’s 21st banking failure of the year and the first in South Carolina since July 2011.

Speak Your Mind

You must be logged in to post a comment.