September 24, 2010 – North County Bank, Arlington, Washington, a four branch bank founded in 2001, was closed today by the Washington Department of Financial Institutions, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with Whidbey Island Bank, Coupeville, Washington, to assume all deposits and purchase all assets of failed North County Bank.

North County had been issued a “Cease and Desist” order by the FDIC in August 2009, due to its “unsafe or unsound banking practices and violations of law”. The FDIC also charged that the bank operated with “a board of directors which has failed to provide adequate supervision over and direction to the active management of the bank”. After the FDIC order was issued, North County Bank President Jack Myles said “It’s not like we’re shutting down lending at all. Gradually those real estate loans are being absorbed”.

North County was unable to raise additional capital or meet other requirements of the FDIC Cease and Desist order. As a result the FDIC issued a Prompt Corrective Action Directive on June 24, 2010, citing the bank’s “significantly undercapitalized” condition. The FDIC also stated that the “Bank continues to deteriorate” and “the management of the Bank has not demonstrated the ability to return the Bank to a safe and sound condition”.

All branches of North County will reopen on Monday as branches of Whidbey Island Bank and deposits will continue to be insured by the FDIC. Customers of North County Bank will have full access to their accounts over the weekend.

At June 30, 2010, North County Bank had total assets of $288.8 million and total deposits of $276.1 million. Whidbey Island Bank will pay a 2% premium to the FDIC to assume all deposits of failed North County.

Whidbey Island Bank purchased all failed assets of North County Bank and entered into a loss-share transaction with the FDIC on $221.9 million or 77% of the purchased assets. The loss-share agreement limits the potential loss to Whidbey on the purchased assets. The FDIC said that losses will be minimized by keeping the asset pool in the private sector.

As the banking industry has stabilized and additional banks and investors bid to purchase failed banks, the FDIC has been able to lower the amount of loss-share protection given to failed bank buyers. Loss-share coverage has been reduced from 95% to 80% or lower depending on asset pool quality.

The FDIC has generally had success with loss-share agreements in the past based on a recovery in property market values. Addressing the issue of possible additional losses down the road, the FDIC states that:

When the FDIC calculates the estimated cost of a failure, it takes into account expected losses on the assets covered in loss share agreements. Thus the cost of expected future payments is included. If credit losses are less than expected, then the FDIC will lose less than anticipated; if credit losses are more than expected, then the FDIC will lose more than anticipated. Actually, loss sharing has proven to be effective in the past.

The FDIC has already entered into loss-share agreements on about $200 billion of failed bank assets. If property markets continue to weaken and credit losses are more than expected, the FDIC could be liable for billions of dollars in additional payments, exposing the American taxpayer to additional losses. Meanwhile, the Deposit Insurance Fund, which is used to cover banking losses, has been depleted and currently has a negative balance of $15.2 billion (see FDIC Loss-Share Guarantees Balloon To $177 Billion).

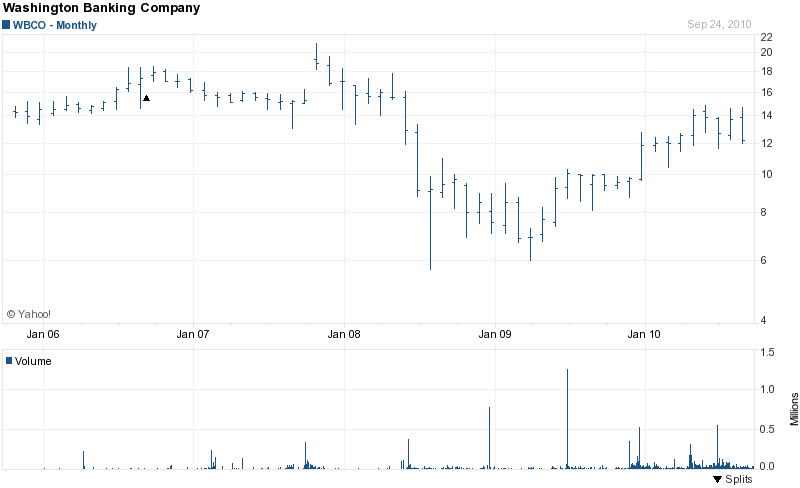

Whidbey Island Bank has 26 branches, $1.6 billion in assets and is a subsidiary Washington Banking Company. In April, Washington Banking Company acquired another failed bank, City Bank, Lynnwood, Washington, which had $715 million in assets. Washington Banking is profitable but received $26,380,000 in TARP funds from the US Treasury in January 2009. None of the TARP funds have been repaid to date and Washington Banking has paid over $2 million in dividends to the US Treasury.

WBCO - COURTESY YAHOO FINANCE

The estimated loss to the FDIC Deposit Insurance Fund for closing North County Bank is $72.8 million or 25% of total assets. North County Bank is the nation’s 127th banking failure and the ninth in Washington.

Speak Your Mind

You must be logged in to post a comment.