The fifth largest bank failure of the year occurred in Florida today as regulators closed the $1.7 billion asset Lydian Private Bank of Palm Beach. Although the banking failures of 2011 do not come close to the size of bank failures witnessed during the financial meltdown of 2008, the collective size of this year’s banking failures is starting to mount.

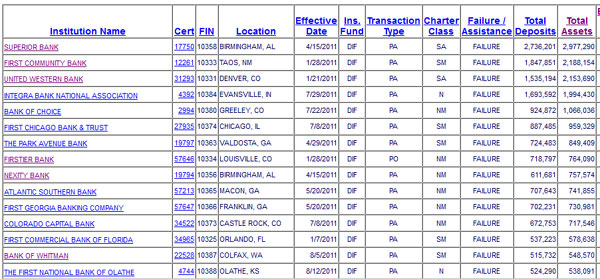

The six banks that failed this year with assets in excess of $1 billion had a total of $12 billion in assets. Another eleven banks with assets in excess of $500 million but below $1 billion have also failed this year. Total assets of the 66 banks that have failed year to date amounted to $29 billion with total losses to the FDIC Deposit Insurance Fund of $5.7 billion.

Lydian Private Bank was originally founded by Rory Brown, a former executive of subprime lender Ocwen Financial Corp in early 2000 as Virtual Bank. In 2002, the Bank changed its named to Lydian Private Bank and focused on serving high wealth individuals through their wealth management division.

Brown decided to name the bank after the country of Lydia (current day Turkey) which produced the world’s first coins around 600 B.C. A copy of a Lydia coin became the Bank’s trademark symbol, representing old wealth.

Although Lydian Bank was profitable during the boom years like every other bank in the country, conditions deteriorated rapidly as the super inflated Florida property markets started to crumble in 2008. The Bank’s losses increased and the Bank quickly became critically undercapitalized.

Lydian Private Bank was issued a Cease and Desist Order in September 2010 by the Office of Thrift Supervision which cited the bank for numerous unsafe and unsound banking practices and inadequate levels of capital. Bank management’s attempts to lure private investor capital into the Bank was unsuccessful.

The FDIC, acting as receiver, sold the failed Bank to Sabadell United, N.A., Miami, Florida, which will assume all deposits of failed Lydian Private Bank. All five branches of Lydian will reopen on Monday as branches of Sabadell and depositors will have full access to their money over the weekend through the use of checks, debit cards or by using ATM machines.

At June 30, 2011, Lydian had total assets of $1.70 billion and total deposits of $1.24 billion. Sabadell United agreed to purchase all of Lydian’s assets subject to a loss-share agreement with the FDIC which will limit future losses to Sabadell. The loss-share agreement will cover $907.1 million of the asset pool acquired by Sabadell.

Sabadell United Bank is owned by Banco Sabadell, a Spanish bank.

Lydian Private Bank becomes the nation’s 66th banking failure of 2011 and the 10th in Florida. The loss on the closing of Lydian is estimated at $293.2 million.

Speak Your Mind

You must be logged in to post a comment.