Banking Failures in Nevada and Washington Bring 2010 Total To 22

The weekly banking failures continue as regulators closed two more failed banks in Nevada and Washington. The two failed banks had total assets of $769 million and total deposits of $496 million. The cost to the FDIC Deposit Insurance Fund (DIF) for this week’s bank failures is estimated at $103 million. The cost to the FDIC Deposit Insurance Fund (DIF) for the 22 banking failures to date in 2010 now totals $4.4 billion.

Both failed banks were taken over by other institutions under purchase and assumption agreements with the FDIC, whereby the deposits and most of the assets of the failed bank are taken over by the acquiring bank. As has been the case with almost all failed banks, the FDIC agrees to share in losses on purchased failed bank assets through a loss-share agreement with the acquiring bank.

One of this week’s banking failures, Carson River Community Bank, was a tiny, one branch bank with assets of only $51 million. The loss to the FDIC on the Carson River failure was only $7.9 million. The larger banking failure of the week was Rainier Pacific Bank with $718 million in assets and the loss to the FDIC is estimated at $95.2 million.

While most banking failures of the past few years have been the result of poor lending decisions, Rainier Bank’s failure was mainly due to poor investment decisions. Rainier Bank’s large investment of $109 million in trust preferred collateralized debt obligations resulted in catastrophic losses that ultimately lead to the bank’s collapse. As of the end of last year, Rainier’s $109 million investment had declined to only $23 million, causing the bank to become critically undercapitalized, prompting regulators to close Rainier.

Carson River Community Bank, Carson City, Nevada – Banking Failure Number 21

The FDIC, as receiver, entered into a purchase and assumption agreement with Heritage Bank of Nevada, Reno, Nevada to assume all of the deposits and to purchase $38 million of assets of Carson River Bank. At the time of closing, Carson River had $51 million in assets and $50 million in deposits. The FDIC entered into a loss-share transaction on $28.5 million of the acquired assets to limit future potential losses to Heritage Bank. The FDIC is retaining $23 million of the failed bank’s assets for later disposition.

The loss to the FDIC on closing Carson River Bank is estimated at $7.9 million. Carson River Bank is the first bank to fail in Nevada this year.

Rainier Pacific Bank, Tacoma, Washington – Banking Failure Number 22

Rainier Bank’s closure followed months of unsuccessful efforts to raise additional capital. Rainier Bank was classified as undercapitalized by the FDIC when they issued a “Supervisory Prompt Corrective Action Directive” on September 8, 2009. After the Bank was issued a cease and desist order in October, 2009, Rainier’s management made it clear that they did not expect to be successful in raising additional capital and issued the following statement:

“Given the generally soft current market conditions for bank mergers and acquisitions, and the desire for FDIC-assisted transactions by many acquirers, it is unlikely that the company’s efforts to meet the recapitalization requirements will be successful prior to any further or more severe actions that the company’s and the bank’s regulators may take, including the assumption of control of the bank to protect the interests of the depositors insured by the FDIC.”

Trust preferred securities are debt securities issued by banks. During the past decade, regional and small banks issued about $50 billion in trust preferred securities. Prior to the banking crisis, the trust preferred securities appeared to be safe investments since the securities had senior claim positions if the issuing bank failed. These bank issued securities were bundled together and sold as trust preferred collateralized debt obligations (CDO). Rainier Bank bought these CDOs for their investment portfolio.

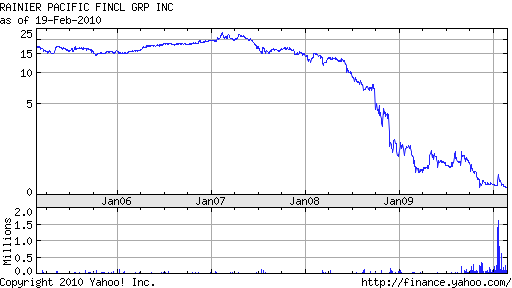

The meltdown in the value of these CDOs occurred when earnings of the issuing banks collapsed and the probability of default on the trust preferred securities became likely. Debt rating downgrades on the CDO’s further contributed to a plunge in values. What Rainier Bank perceived to be a “safe investment” quickly became the major contributing factor in the failure of the bank. Rainier shares (RPFG) have declined from above $22 per share in 2007 to close at 18 cents on Friday – investors now face a complete loss.

Yahoo Finance

The FDIC, as receiver, entered into a purchase and assumption agreement with Umpqua Bank of Roseburg, Oregon to assume all of the deposits and to purchase $670 million of assets of Rainier Bank. At the end of last year, Rainier had $717.8 million in assets and $446.2 million in deposits. The FDIC entered into a loss-share transaction on $578.1 million of the acquired assets to limit future potential losses to Umpqua Bank. The FDIC is retaining $48 million of the failed bank’s assets for later disposition.

The loss to the FDIC on closing Rainier Bank is estimated at $95.2 million. Rainier Bank is the fourth bank to fail in Washington this year.

Banking Links – February 26, 2010

Banks In Crosshairs Again – Blamed For Greek Debt Crisis – WP

Fannie Mae Losses Top $120 Billion – No End In Sight For Taxpayer Bailout – Bloomberg

Speak Your Mind

You must be logged in to post a comment.