First Commercial Bank of Tampa Bay, Tampa, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the FDIC as receiver. The FDIC sold the failed bank to Stonegate Bank, Fort Lauderdale, Florida, which will assume all deposits and purchase all assets.

First Commercial Bank was a small, two branch, locally owned community bank founded in 1989. The Bank’s primary market was the Tampa Bay area which has experienced a large collapse in real estate values. First Commercial Bank was owned by its holding company, FCB Financial, Inc. Investors in FCB Financial have seen the value of their stock decimated, with the stock closing today at $0.01 per share.

Local depositors of First Commercial will have access to their money over the weekend by writing checks or using ATM or debit cards. The failed bank will reopen Monday as a branch of Stonegate Bank.

At March 31, 2011, First Commercial Bank had total assets of $98.6 million and total deposits of $92.6 million. Stonegate will pay the FDIC a premium of 0.50% to assume the deposits of failed First Commerical. In addition, Stonegate agreed to purchase the assets of First Commercial.

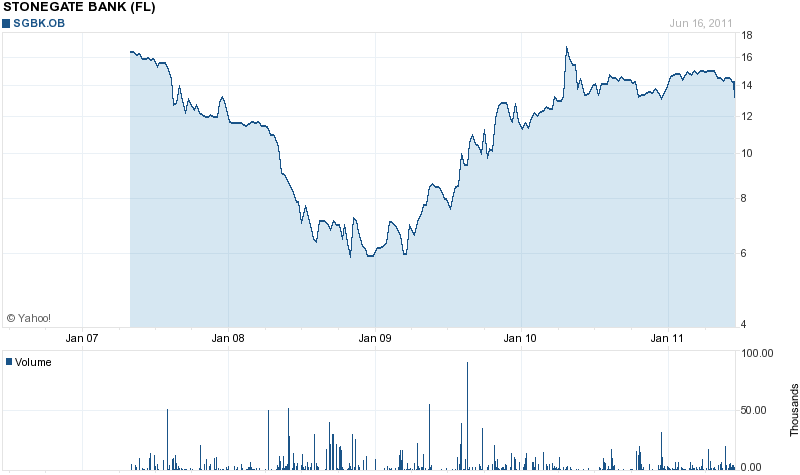

Stonegate Bank is a well capitalized bank with $761 million in assets. The Bank has had 21 straight quarters of profitability and in the first quarter of 2011 had profits of $1.4 million, up 74.5% from the prior year. The Bank’s stock price has more than doubled from the lows of early 2009.

This is the fourth acquisition of a failed bank by Stonegate Bank. In 2009, Stonegate purchased three failed Florida banks, Hillcrest Bank Florida, Partners Bank and Integrity Bank

The FDIC estimate the loss for the failure of First Commercial Bank at $28.5 million. First Commercial Bank becomes the nation’s 47th banking failure and the 6th in Florida.

Speak Your Mind

You must be logged in to post a comment.