Illinois, which has not seen a banking failure since April, witnessed the collapse of a billion dollar bank today as regulators closed First Chicago Bank & Trust, Chicago, Illinois.

First Chicago is the fifth and largest banking failure in Illinois this year. The four banks that failed in Illinois prior to today were relatively small with total assets of $524.8 million.

The FDIC, acting as receiver, sold failed First Chicago to Northbrook Bank & Trust Company, Northbrook, Illinois. Northbrook Bank will assume all of the deposits and purchase most of the assets of First Chicago. All seven branches of First Chicago will reopen as branches of Northbrook Bank & Trust Company. Depositors will have full access to their money over the weekend through debit cards, ATMs or by writing checks.

First Chicago had total assets of $959.3 million and total deposits of $887.5 million. Northbrook Bank will pay the FDIC a premium of 0.50% on the assumed deposits of First Chicago.

Northbrook Bank agreed to purchase only $880.7 million of First Chicago’s assets. The FDIC agreed to limit potential losses to Northbrook Bank by entering into a loss-share transaction on $699.8 million or 80% of the asset pool purchased.

First Chicago was under regulatory scrutiny since it signed an Agreement with the Federal Reserve and state regulators in March 2010. Among the many orders issued by regulators, First Chicago was ordered to raise additional capital. Most small and mid sized problem banks find it extremely difficult to raise additional capital. Property markets continue to decline, quality loan demand is weak and potential bank investors simply do not believe the asset values that banks have on their books.

First Chicago is a prime example of an insolvent bank that was given time to accomplish the impossible task of raising additional capital. The loss to the FDIC for closing First Chicago is estimated at $284.3 million implying that First Chicago’s assets were worth 30% less than market value. No investor is going to pump money into a bank that is hopelessly insolvent and carrying assets far above market value.

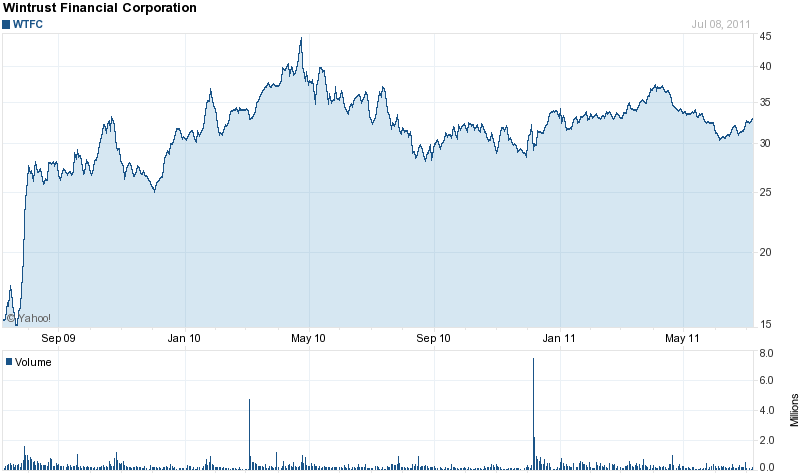

Northbrook Bank & Trust is owned by parent company Wintrust Financial Corporation which has $14 billion in assets. Wintrust had borrowed $250 million under the TARP program but repaid the loan in full on December 22, 2010. Wintrust previously acquired four other failed banks with almost $2 billion in assets in 2010 and 2011. Wintrust’s stock price has more than doubled since the lows of 2009.

First Chicago Bank & Trust Company becomes the nation’s 49th banking failure of the year and the fifth in Illinois.

Speak Your Mind

You must be logged in to post a comment.