Central Progressive Bank, Lacombe, Louisiana, was closed today by state regulators who appointed the FDIC as receiver. The FDIC sold the failed bank to First NBC Bank, New Orleans, LA, which will assume all deposits of Central Progressive.

Central Progressive Bank was founded in 1967 to serve the banking needs of the Northshore communities of Louisiana, according to the Bank’s website. Like many similar failed banks, Central Progressive aggressively expanded its loan portfolio during the real estate boom and subsequently experienced a massive number of loan defaults as real estate values declined in the wake of the 2008 financial meltdown.

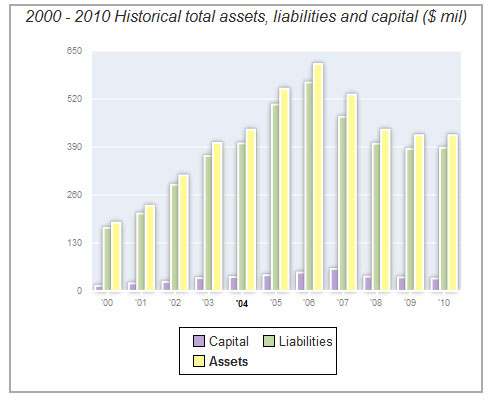

During the seven years ending in 2006, Central Progressive increased its assets by over 230%. The number of defaulting loans grew rapidly and by the middle of 2011, the Bank had a troubled asset ratio of 468%, well past the 100% mark which usually signals that a bank failure is imminent.

In January 2009, Central Progressive was issued a Cease and Desist order by the FDIC which cited the Bank for a wide range of unsafe and unsound banking practices. Central Progressive broke almost every rule of sound banking practices ever written, as detailed below in the FDIC Cease and Desist order.

1. Operating the Bank with an inadequate level of capital protection for the kind and quality of assets held by the Bank.

2. Operating the Bank with inadequate earnings to fund growth, support dividend payments and augment capital.

3. Operating the Bank with an excessive level of adversely classified loans or assets

4. Operating the Bank with an excessive level of delinquent and nonaccrual loans.

5. Operating the Bank without a viable strategic plan

6. Creating concentrations of credit.

7. Operating the Bank with management whose policies and practices are detrimental to the Bank and jeopardize the safety of its deposits.

8. Operating the Bank without adequate supervision and direction by the Bank’s board of directors over the management of the Bank to prevent unsafe and unsound banking practices and violations of laws or regulations.

9. Operating the Bank in violation of applicable Federal and State laws and regulations.

10. Failing to adequately document business expenses.

11. Operating with excessive overhead costs.

12. Operating the Bank with a heavy reliance on short-term potentially volatile deposits as a source for funding long-term investments.

13. Operating the Bank without adequate liquidity or proper regard for funds management in light of the Bank’s asset and liability mix.

14. Operating the Bank with excessive levels of interest rate risk.

All 17 branches of Central Progressive will reopen on Saturday as branches of First NBC Bank and depositors will continue to be covered by FDIC deposit insurance up to the applicable limits. Over the weekend, customers of Central Progressive can access their money through the use of ATM, checking or debit cards.

The cost to the FDIC deposit insurance fund for failed Central Progressive is estimated at $58.1 million. Central Progressive Bank becomes the nation’s 90th banking failure of 2011 and the first in Louisiana this year.

Speak Your Mind

You must be logged in to post a comment.