The uproar on social media and complaints filed with regulatory agencies about the M&T/People’s merger fiasco has been so loud that the Attorney General for the State of Connecticut has become involved. People’s United customers have endured long waits at branch offices, inability to access their accounts, ridiculously long hold times when calling the bank, […]

Problems for M&T/People’s Bank Merger Escalate as Connecticut Attorney General Gets Involved

Worst Bank Merger Ever – M&T Bank and People’s United – Nothing Works, and You Can’t Reach a Bank Rep

Customers of People’s United Bank are furious over the horrendous outcome of their merger with M&T Bank. It’s not like the banks didn’t have enough time to plan the merger. M&T Bank completed the acquisition of People’s United on April 1, 2022 – a full six months ago. Vermont Biz M&T Bank Corporation (NYSE: MTB) […]

Billion Dollar Bank Failure – Guaranty Bank of Wisconsin Closed by Feds

For the second week in a row a billion dollar bank was closed by regulators. Last week it was First NBC Bank of New Orleans and today it was Guaranty Bank, Milwaukee, Wisconsin (doing business as Best Bank in Georgia and Michigan). Overwhelmed by bad loan, the Comptroller of the Currency shuttered Guaranty Bank and […]

Five Billion Dollar Bank Failure – First NBC Bank, New Orleans, Closed by Regulators

A very large bank failure occurred today when state regulators closed First NBC Bank, New Orleans, and appointed the FDIC as receiver. To prevent losses to depositors, the FDIC took a significant hit to its Deposit Insurance Fund and sold First NBC Bank to Whitney Bank, Gulfport, Mississippi. In terms of asset size the collapse of […]

Allied Bank, Mulberry, AK, Becomes Fifth Bank Failure of 2016

It’s been six years since a bank failed in the state of Arkansas but this trend ended on Friday when state regulators closed Allied Bank in Mulberry, Arkansas. The failure of Allied Bank apparently had no linkage to the health of the overall business environment in Arkansas. According to the Arkansas Banking Commissioner, Candace Franks, “This […]

The Woodbury Banking Company Closed by Regulators

The Woodbury Banking Company, a tiny bank located in Woodbury, Georgia, was closed today by Georgia state regulators. The FDIC, appointed as receiver, sold the bank to United Bank, Zebulon, Georgia, in order to protect depositors of the failed bank. Founded over a hundred years ago in 1902 The Woodbury Banking Company remained a very […]

First Cornerstone Bank, King of Prussia, PA – Largest Bank Failure of 2016

The largest banking failure of the year occurred when state regulators closed the First Cornerstone Bank, King of Prussia, PA. In order to protect depositors, the FDIC in its role as receiver, entered into a purchase and assumption agreement with First-Citizens Bank & Trust Company, Raleigh, North Carolina. First Cornerstone Bank was established in March […]

Trust Company Bank, Memphis, TN, Closed by Regulators

Trust Company Bank, Memphis, Tennessee, was closed by state regulators who appointed the FDIC as receiver. In order to protect depositors the FDIC sold the failed bank to The Bank of Fayette County, Piperton, Tennessee. Trust Company Bank is the second banking failure of the year. The last banking failure of 2016 occurred on […]

North Milwaukee State Bank, WI, First Bank Failure of 2016

The first bank failure of 2016 occurred today when regulators closed a small bank in Wisconsin. It has been almost six months since the last banking failure in the U.S. The last FDIC insured bank failure occurred on October 2, 2015 when regulators closed Hometown National Bank, Longview, WA. North Milwaukee State Bank, Milwaukee, Wisconsin, […]

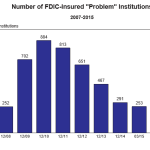

FDIC Insured Problem Banks at Lowest Level Since 2008

The number of banks on the FDIC Problem Bank List continues its steady decline since peaking at 888 banks in March 2011. According to the latest FDIC Quarterly Banking Profile the number of problem banks stood at 203 as of September 30, 2015, down by 25 banks since the previous quarter. The number of problem […]