Two new reports make a compelling case that the markets have not fully discounted the probability of another flood of residential foreclosures precipitated by the continuing decline in home values. The potential impact of price depreciation on the quality of loan portfolios casts serious doubt on the notion of a long term profit recovery for […]

The Compelling Case For A New Wave Of Mortgage Defaults And Bank Failures

Oversight Panel Blasts Treasury For Loan Modification Failure

December 15, 2010 – The Congressional Oversight Panel (COP) was created by Congress during the height of the financial crisis to oversee the handling of $700 billion given to the US Treasury to stabilize the U.S. economy. Part of COP’s responsibility is to issue regular reports on the Treasury’s actions and to guarantee that Treasury’s […]

Banks May Be Facing A Tidal Wave Of Mortgage Defaults

Although bank stocks have rallied recently, it may be premature to expect a recovery for the banking industry. There are multiple indicators that a housing recovery is little more than a distant dream and current trends suggest that mortgage defaults may increase substantially. With banks currently holding approximately $3 trillion dollars in residential mortgages, […]

Government Requests Banks To Buyback $30 Billion Of Defaulted Mortgages

September 15, 2010 – Defaulted mortgage loans sold to Fannie Mae and Freddie Mac during the peak years of the mortgage boom are now resulting in billion dollar losses for some of the largest banks in the country. Fannie Mae and Freddie Mac, now under the conservatorship of the Federal Housing Finance Agency (FHFA), are […]

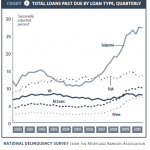

Delinquency Report Suggests Future Increase In Mortgage Defaults

August 28, 2010 – The newly released Delinquencies and Foreclosure report by the Mortgage Bankers Association (MBA) largely mirrors the Federal Reserve Bank of New York’s quarterly report on household debt and credit. The mortgage delinquency rate for one to four unit residential properties decreased slightly to 9.85% and the percentage of loans in foreclosure […]

One Third Of All Americans Unqualified For A Mortgage

August 24, 2010 – According to research from Deutsche Bank, the number of Americans with credit scores below 600 has increased to 26% from only 15% prior to the start of the recession. Further examination of credit data reveals that 9% of all Americans have a credit score in the 600-649 range. Based on current […]

Mortgage Jobs Disappear As Rates Hit All Time Lows

In what can only be described as cruel irony, the number of jobs in the mortgage industry continue to disappear as rates hit all time lows. Traditionally, all time lows in mortgage rates have resulted in a refinance boom, increased hiring by mortgage companies and hefty paychecks for mortgage loan originators. This time, things are […]

Negative Equity Causes Half Of All Mortgage Defaults

June 29, 2010 – Anecdotal evidence has been suggesting for some time that many mortgage borrowers will deliberately chose to default when the mortgage exceeds the value of the property. Empirical research released by the Federal Reserve Board now shows exactly how big a problem strategic mortgage defaults have become for the banking industry. The […]

Government’s Effort To Stop Soaring Mortgage Defaults A Failure

Mortgage Delinquencies and Foreclosures Continue To Soar The record high rate of mortgage delinquencies and foreclosures remains the banking industry’s biggest obstacle towards financial recovery. The horrific statistics for the first quarter on mortgage defaults provides little reason to believe that the housing crisis will end anytime soon. The delinquency rate for all mortgages on […]