June 24, 2010 – Commercial and multifamily delinquencies continued to increase in the first quarter of 2010 according to a report by the Mortgage Bankers Association.

According to Jamie Woodwell, MBA’s Vice President of Commercial Real Estate Research, “Weakness in the economy has continued to weigh on commercial properties, which in turn weighs on the mortgages they back. Economic growth, specifically in areas of jobs and consumer spending, will be key to stabilizing the commercial property and mortgage markets going forward.”

The MBA report includes loans backed by office buildings, apartment buildings, shopping centers and other income producing property. Excluded are construction and development loans which are often backed by single-family residential developments and included in many regulatory reports on commercial loan delinquencies.

Delinquencies are broken down by five categories of investors: commercial banks and thrifts, commercial mortgage-backed securities (CMBS), life insurance companies and Fannie Mae and Freddie Mac. These five investor categories hold over 80% of commercial/multifamily mortgages outstanding. Delinquencies rates increased for all five investor categories.

CMBS had the worst delinquencies at 7.24% which is not surprising since the most aggressive commercial loans made were securitized and sold to various investors. Default rates for other investor groups were as follows: banks and thrifts 4.24%, Fannie Mae .79%, Freddie Mac .24% and life companies .31%. Overall delinquencies have not exceeded the rates seen in the last commercial real estate bust in the 1990’s but remain a source of great concern, especially for banks and CMBS holders since default rates continues to climb.

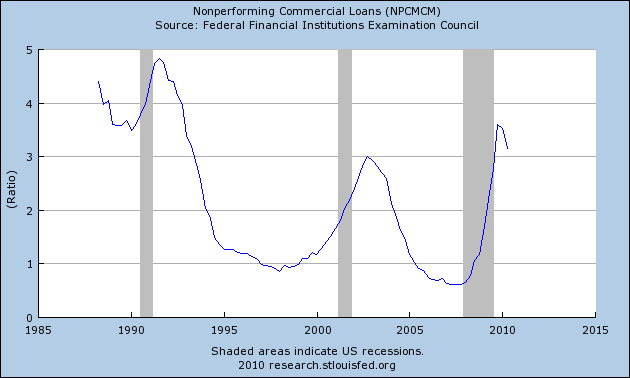

Nonperforming Commercial Loans

Why don’t put the actually number of loans instead of percentages…