Citigroup Faces Tougher Government Regulation

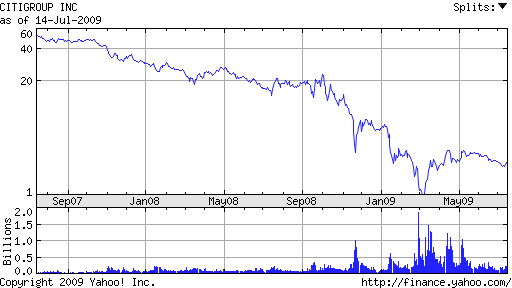

Citigroup, probably the most financially challenged of the major banks, is facing increased regulation by the FDIC. In early June, it was noted that FDIC Chairman Sheila Bair was becoming increasingly frustrated with Citigroup’s management and their inability to implement changes necessary to strengthen the bank.

At one point early in the year, the FDIC reportedly attempted to have Citigroup placed on the Problem Bank List, which would have allowed the FDIC to exert greater control over Citigroup’s operations and management. (See – Will Citigroup Wind Up On The Problem Bank List?). It was not considered likely at the time that Citi would actually be placed on the Problem Bank List. Losing public confidence in one of the nation’s largest banks would have entailed an unacceptable amount of risk and possibly caused Citigroup even greater problems.

Chairman Bair, who had done an exceptional job in attempting to restore sound banking principles, has apparently prevailed in her attempts to exert additional regulatory control over Citigroup. The Financial Times is reporting that Citigroup has agreed to implement changes in its operations and management that the FDIC had been seeking.

The proposed agreement requires, among other things, that Citi strengthens its board and governance, improves asset quality, better manages expenses and provides more information to regulators on its capital and liquidity, these people added.

The regulator’s action highlights concern over Citi’s financial health, governance and the strength of its management team, led by Vikram Pandit, chief executive. The FDIC is known to be frustrated with the slow pace of Citi’s “toxic” assets sales, its losses and the lack of commercial banking experience at the top.

An agreement would strengthen the FDIC’s position in its dealings with Citi and its demands for detailed financial information as it deliberates over whether to include it on its list of “problem banks”.

Agreements between regulators and a bank’s management and board – known as “informal actions” – are not made public to avoid stoking investors’ fears. They can be in a “memorandum of understanding” or a “commitment letter” from the bank to the authorities and are fairly unusual and less serious than formal enforcement actions.

The US Government effectively owns a third of Citigroup due to the large amount of loans and guarantees that were provided by the Government. The FDIC actions should help to ensure that the value of the public ownership of Citigroup increases in value. Hopefully, at some point in the future, the cost of bailing out Citigroup will result in a profit to the taxpayers.

Speak Your Mind

You must be logged in to post a comment.