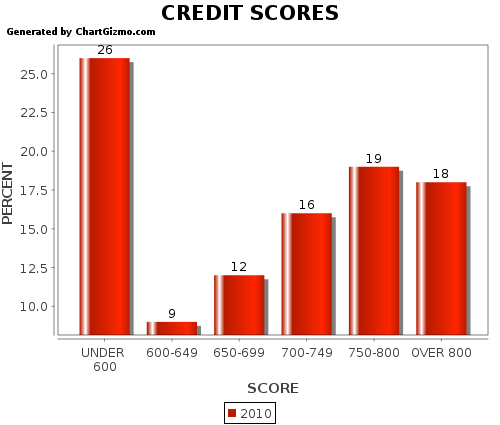

August 24, 2010 – According to research from Deutsche Bank, the number of Americans with credit scores below 600 has increased to 26% from only 15% prior to the start of the recession. Further examination of credit data reveals that 9% of all Americans have a credit score in the 600-649 range.

Based on current credit score requirements for a mortgage approval, any applicant with a score below 600 is almost certain to be turned down by a banking institution. Borrowers in the 600-649 range are also considered “weak” candidates with a high turn down rate, especially if the credit score is below 620.

Based on the total number of Americans with a credit score of 649 or lower, up to 35% of all Americans are effectively locked out of the refinance or purchase mortgage market for the foreseeable future. With foreclosures and default rates constantly increasing, it is conceivable that credit standards could be tightened even further by banks.

CREDIT SCORE DISTRIBUTION

To gain insights into how the current mortgage market differs from previous recessions and the implications for banks and borrowers, I interviewed Don Luth, Executive Loan Consultant with over 30 years of experience, at HamiltonLadd Home Loans, Ridgefield, CT.

PBL – Don, what’s your take on the increasing number of borrowers with low credit scores?

Luth: I do not have access to the same statistical data you mentioned but from my 30 plus years in the mortgage business…

Recessions equal a higher unemployment rate.

Higher unemployment rates lead to higher mortgage and/or consumer credit delinquency rates.

Higher delinquency rates negatively impact credit scores on a larger percentage of the total consumer population.

So there is no doubt in my mind – we now have a larger segment of consumers that have a lower credit score than before this recession began.

PBL – What actions have banks taken to compensate for lower credit scores and how does this housing recession differ from previous ones?

Luth: As a result of the decline in real estate values and higher unemployment rates, the banks had no choice but to tighten credit standards across the board.

In the most recent two recessions (excluding the one we are in today) a sub 600 credit score consumer with a job and verifiable income had the option of either selling their home to eliminate debt or they could possibly qualify for a sub prime mortgage refinance.

Sub prime lenders actually experienced an increase in market share during the prior recessions. Companies like Beneficial Finance, Household Finance, Nations Credit, Avco Finance, and Security Pacific Finance to name just a few.

Those companies were portfolio lenders who stepped in to bridge the financing gap when banks tightened their lending standards and effectively excluded most sub 600 score borrowers from the mortgage market.

But for all intent and purpose– sub prime lending has now been legislated out of business. So the sub prime financing options that were available to the sub 600 score consumer during prior recessionary periods are no longer available today.

Their exit from the landscape is one of the primary reasons why FHA’s market share has risen so significantly in the past two years.

PBL – The FHA has also seen a large number of defaults and have imposed tougher underwriting guidelines. How difficult is it to get an FHA approval today and what are the options for borrowers with who cannot qualify for conventional or FHA financing?

Luth: One of the more liberal mortgage programs from a qualification standpoint in today’s market is the still the FHA 203B mortgage program. But even FHA lenders have tightened their lending standards a great deal in the past two years. Credit scores today generally need to be 620 or greater and consumers with a credit score below 660 will pay a higher interest rate.

In addition, every new FHA applicant “regardless of their score” must now pay a significantly higher cost for FHA’s mortgage insurance premiums.

Frankly the only (low rate) mortgage product that readily comes to mind for a consumer with a sub 600 score is a Reverse Mortgage.

The reverse mortgage product “does not” have a minimum credit score qualification requirement. But a qualified applicant needs to be 62 years or greater.

The maximum loan limits for a reverse mortgage have declined due to adverse market conditions but the overall qualifications needed to obtain a reverse mortgage, such as no credit score requirement – have not been changed over the past 24 months.

PBL –At this point, very few analysts are forecasting a quick turnaround in the real estate or mortgage market. What’s your take on this and what needs to be done to ensure a sound banking system going forward?

Luth: I’m afraid this recession will take a much deeper toll on consumer credit scores and credit availability than any recession we’ve experienced in the past 30 years.

The majority of banks (including all of the GSE’s) allowed way to much leverage to occur on behalf of the consumer.

The foundation for bank lending standards which included an analysis of the borrowers ability, stability and willingness to repay a mortgage loan – all took a backseat – to what I can only describe as sheer greed for short term profits.

Needless to say, these same banks now need to rid their balance sheets of the substantial numbers of REO properties and take the losses before we’ll see any improvement in today’s stringent credit standards for a new mortgage loan.

PBL – Thanks Don.

Speak Your Mind

You must be logged in to post a comment.