The Office of the Comptroller of the Currency (OCC) painted a gloomy picture for the housing markets with its release of the OCC Mortgage Metrics Report for the third quarter of 2011. Mortgage delinquencies remain at high levels and foreclosures increased by double digits.

The OCC report covers mortgages serviced by federal savings associations and large national banks which include approximately 62% of all first mortgages with an outstanding principal balance of $5.6 trillion.

Key findings of the report included the following:

1. One out of every eight mortgages (12%) are currently delinquent. Prior to the relaxation of credit standards that occurred during the housing bubble years, the norm for delinquencies on conforming mortgages was only a fraction of 1%.

2. Foreclosures increased by over 21% during the third quarter as various well intentioned but futile mortgage moratoriums came to an end. At the end of the third quarter, 1.3 million mortgage loans were in the foreclosure process. According to Lender Processing Services, the average time for a foreclosure to work its way through the system set a new record of 631 days or almost 2 years. Keep in mind that this is only the time spent in foreclosure. Many lenders do not begin the foreclosure process until the loan has been delinquent for 6 to 12 months or longer.

Accordingly, many of the homeowners in the foreclosure process have been living “rent and mortgage free” for 3 years or longer. Since many of the homeowners being foreclosed upon received their mortgages during the easy lending years when 100% financing was almost universal, the result has not been “financial hardship” but rather a financial bonanza.

Misguided government efforts to keep homeowners in homes that they cannot afford while at the same time allowing them to enjoy free housing has only prolonged the housing crisis by perpetuating a huge overhang of shadow inventory that delays free market forces from allowing housing prices to bottom out.

3. Massive, expensive and time consuming government programs to “modify” mortgages have basically been a disaster which have extended the housing crisis to the same degree as foreclosure moratoriums. Since 2008 a total of 2,258,026 mortgages have been modified, resulting in payment reductions of up to 35% or $567 per month.

Those homeowners who made conservative financial decisions, saved for a significant down payment and are making their mortgage payments on time even if it involves financial sacrifice may wonder if the government is being fair. Perhaps they haven’t heard that the new mantra for improving the economy is to “share the wealth”. Those debating the proper role of government in the foreclosure crisis should consider the words of Austrian economist F.A. Hayek who said that “There is all the difference in the world between treating people equally and attempting to make them all equal.”

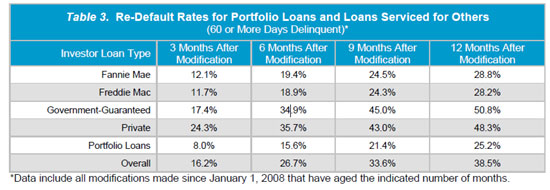

The result of the government’s effort to stabilize housing by modifying mortgages is shown in the OCC chart below and is an unmitigated disaster. The re-default rates for borrowers 12 months after modification is sky high at almost 40%. Keeping people in homes that they simply cannot afford makes zero sense. Incongruously, the government has vowed to redouble its efforts at loan modification under the theory that not enough modifications were implemented. Expect the expanded version of loan modification to mirror the disastrous results of the original loan mod programs.

A recent study predicts that the foreclosure crisis in not even in the fifth inning yet. In a report entitled “Lost Ground, 2011” the Center for Responsible Lending says:

As the nation struggles through the fifth year of the foreclosure crisis, there are no signs that the flood of home losses in America will recede anytime soon. Among the findings in this report, Lost Ground,2011, we show that at least 2.7 million households have already lost their homes to foreclosure, and more strikingly, that we are not even halfway through the crisis.

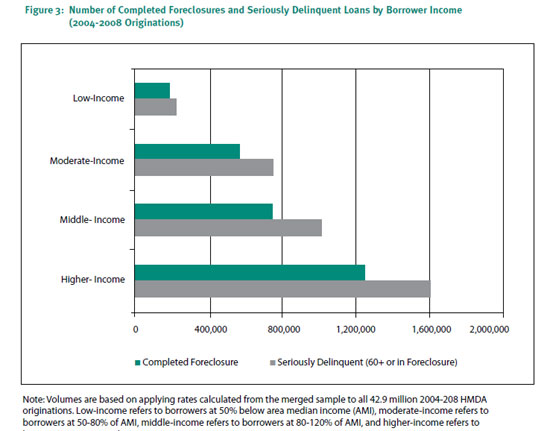

One interesting set of facts in the Lost Ground report that may seem counter intuitive at first is the fact that the largest amount of loan delinquencies and foreclosures have occurred in the highest income levels.

The higher income groups apparently made a rational and rapid decision that default was the best option. Why continue making a large mortgage payment on a house that is worth considerably less than the mortgage balance? Does anyone really think that a house purchased for $1 million 5 years ago and now valued at under $400,000 will increase in value by 150% any time soon?

Not specifically addressed in the gloomy report by the Center for Responsible Lending is the potential flood of foreclosures from the 8 million homeowners still hanging on and making payments on homes that are worth far less than the mortgage balance. Unless housing values and incomes rapidly increase due to a miraculous economic recovery, we are facing a torrential flood of foreclosures as millions of underwater home owners eventually conclude that defaulting is the only financially sound option for getting out of “housing prison”.

Delaying Foreclosure: Borrowers Keep Homes Without Paying

The ensuing delays are further harming the housing market. People who stay in homes undergoing foreclosure for years often don’t maintain the properties, causing blight and lowering property values in the surrounding neighborhoods, said Dunn.

Then there are the court costs that lenders bear, which will eventually be borne by home buyers as lenders increase their borrowing fees to cover the increased risk, Dunn said.

If you’re a homeowner with an adjustable-rate mortgage (ARM), you may choose to lock into a fixed rate if you anticipate rates will be going up soon, thereby stabilizing your monthly payments. I have used 123 Refinance to compare refi rates.

Then the banks should redo the mortgages for what they are worth and let people choose to keep or sell.

Massive, expensive and time consuming government programs to “modify” mortgages have basically been a disaster which have extended the housing crisis to the same degree as foreclosure moratoriums. Since 2008 a total of 2,258,026 mortgages have been modified, resulting in payment reductions of up to 35% or $567 per month.JUST A BIG LIE. Where did you get this figure? No way can you substantiate it!

Reason so hard to modify? No one knows who the owner of the mortgage note is! Also this article fails to mention MERS. MERS is under a CONSENT ORDER. Why no mention of this? Why no mention of Lender Processing Services and their continuing FRAUD? Why no mention of large investors suing all the big banks for their faulty UNsecured Mortgage backed securities? This article is trying to show that mortgage refis, mods are a failure without mentioning the real reasons! WHERE IS THE ORIGINAL MORTGAGE NOTE? WHO IS THE HOLDER IN DUE COURSE? WHO IS THE BENEFICIAL OWNER OF THE MORTGAGE NOTE? Fight the banks…and win when you ask these questions that they can not answer. BTW glenromero is a bank stooge, clearly!

Why would we make stuff up? Straight out of the OCC Mortgage Metrics Report for the third quarter 2011.

“HAMP modifications reduced payments by an average of $567, or 35.1 percent and other modifications reduced monthly payments by $262 (see table 24). Nearly 90 percent of all modifications made during the third quarter reduced monthly payments (see table 22). “

The facts don’t matter to misinformed people, a situation which seems to apply here. This from npr.org.

“New research suggests that misinformed people rarely change their minds when presented with the facts — and often become even more attached to their beliefs. The finding raises questions about a key principle of a strong democracy: that a well-informed electorate is best.

We’d like to believe that most of what we know is accurate and that if presented with facts to prove we’re wrong, we would sheepishly accept the truth and change our views accordingly.

A new body of research out of the University of Michigan suggests that’s not what happens, that we base our opinions on beliefs and when presented with contradictory facts, we adhere to our original belief even more strongly.”

A bonanza? It seems like whomever owns these foreclosed homes (the banks and slumlords) aren’t taking care of the properties. This is the problem neighborhoods are facing now, all over America.

http://youtu.be/kS7QQTOn6Z8

Its amazing how long can individuals keep a property without paying mortgage or taxes. I see this situations every day.

I am the principal broker of PDX Experts, Real Estate, LLC., a top real estate firm in Portland, Oregon. I do a lot of short sales. That is my forte.

Presently I have clients that have not paid the mortgage or property taxes since 2009. This is a very common situation. Most often, this homeowners contact me not because of being behind in payments, but because the HOA (homeowners association) is about to, or already has a placed a judgment on them. This eventually results in the payment, legal expenses, arrears and other cost being paid directly from their wages.

Here in Oregon, we have just passed from non-judicial foreclosure to judicial foreclosures. This has created a huge backlog. It is very reasonable to expect that most homeowners not paying their mortgage can keep their homes for at least a year. Most likely 2 to 5 years.

I always inform people in default that they can keep their property for a lot longer without paying anything other than utilities. Even like that, some homeowner are so tired of the situation that they still want to sell on a short sale just to get it over.

If you need to short sale a property contact me, Oscar Morante, at 971-222-3734 and visit my web site http://www.PDXexperts.com.