December 22, 2010 – Besieged by slow loan growth, loan defaults and costly new regulations, the banking industry is turning to mergers and acquisitions to rebuild profits. In the latest wave of recent bank acquisitions, Hancock Holding Company and Whitney Holding Company announced that Whitney would merge into Hancock in a stock-for-stock transaction.

Both banks have a long history in the Gulf States region. Hancock Holding is the parent company of 112 year old Hancock Bank and Whitney Holding is the parent company of Whitney National Bank, founded in 1883. Whitney shareholders will receive .418 shares of Hancock common stock in exchange for each share of Whitney common stock, giving the transaction a value of $1.5 billion. Based on Hancock’s closing price at the time of the deal’s announcement, the value of each Whitney share would be $15.48, a premium of 42%.

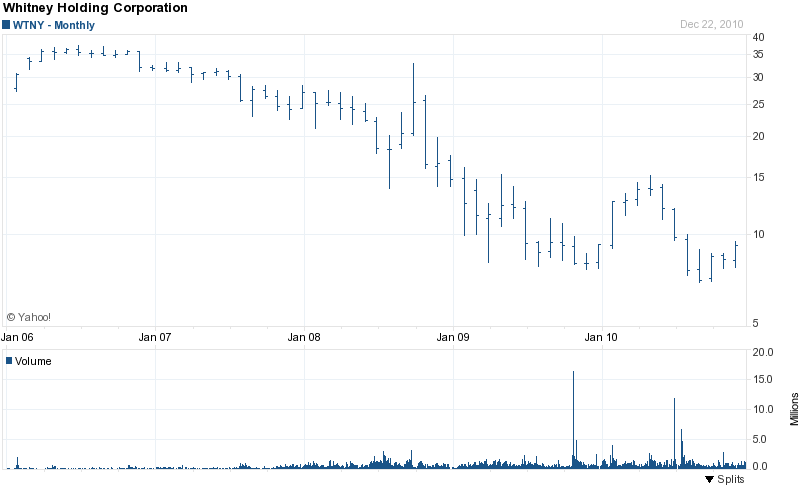

Whitney Holding lost $78 million for the year ending December 31, 2009 and has had losses each quarter in 2010, totaling $65 million through September 30. Despite the recent losses, Whitney management “expects to be in an excellent position to begin a return to consistent, quarterly profitability in the first quarter of 2011”. Despite the losses of the past two years, Whitney’s capital ratios remained above regulatory requirements and the Bank was considered well capitalized.

Despite Whitney’s forecast of a turnaround in 2011, many investors had remained skeptical of the company’s recovery. At November 30, over 10% (9.6 million shares) of the Bank’s common stock had been sold short by investors betting against Whitney’s recovery. After the takeover announcement, Whitney’s shares soared 29%, closing at $14, up $3.13 for the day. Despite the ongoing difficulties in the banking industry, it is likely at this point that most of the bad news has already been discounted by investors and reflected in current bank stock prices.

Although shareholders have seen the price of Whitney’s common shares decline from around $35 per share in 2006, the merger with Hancock provides hope for an eventual recovery of their investment.

When the takeover of Whitney is completed, the combined company will have $20 billion in assets, $12 billion in loans, $16 billion in deposits, 305 branches and 5,000 employees. The two banks operated in complementary geographic locations, doing business in Louisiana, Mississippi, Texas, Florida and Alabama.

The primary benefits to both banks in merging will be from cost cutting as overlapping branches are closed and employees laid off. Bank management views the merger as “an unprecedented opportunity to enhance shareholder value”. Cost savings of $134 million are expected once the merger is completed which is expected to increase earnings by 19% in 2013. The Banks also plan to raise an additional $200 million in capital through a common stock offering

The ongoing consolidation of the banking industry will likely result in the loss of thousands of jobs in an already weak labor market. Despite the obvious hardship to those employees losing their jobs, Whitney management believes that it is “the best course of action for our employees”. The top five executives at Whitney Bank all make well in excess of $300,000 per year with CEO John Hope at $750,000 per year.

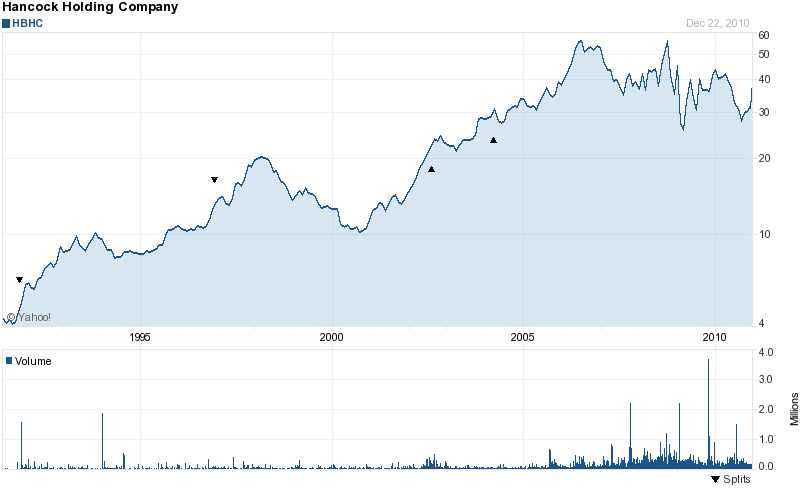

Hancock Bank has consistently been rated as one of the country’s strongest and safest banks for 21 years according to management. The financial crisis had virtually no impact on Hancock Bank which continued to generate solid profits over the past three years. Hancock Bank said that it expects to repurchase all of Whitney’s $300 million of TARP preferred stock held by the US Treasury.

Although Hancock’s stock price declined during the banking crisis, long time shareholders have seen substantial gains.

Other large regional banks have seen their stock prices increase lately on takeover speculation. Many analysts are expecting a wave of banking acquisitions as the weakened banking industry consolidates to survive. Shares of SunTrust Banks and Regions Financial are among the banks that have seen their stock prices climb recently based on takeover talk.

Whitney National Bank will witness their shares go up – Boom!