October 1, 2010 – Wakulla Bank, Crawfordville, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the FDIC as receiver. Centennial Bank, Conway, Arkansas, acquired the failed bank under a purchase and assumption agreement with the FDIC. Centennial Bank will assume all the deposits and purchase essentially all of the assets of failed Wakulla Bank. Wakulla Bank had been in business for 36 years, having been established in 1974.

Centennial Bank previously acquired two other failed banks this year in Florida through FDIC-assisted transactions. Centennial added eight new branches to their banking network through the acquisition of Old State Bank in Orlando, Florida and Key West Bank in Key West, Florida.

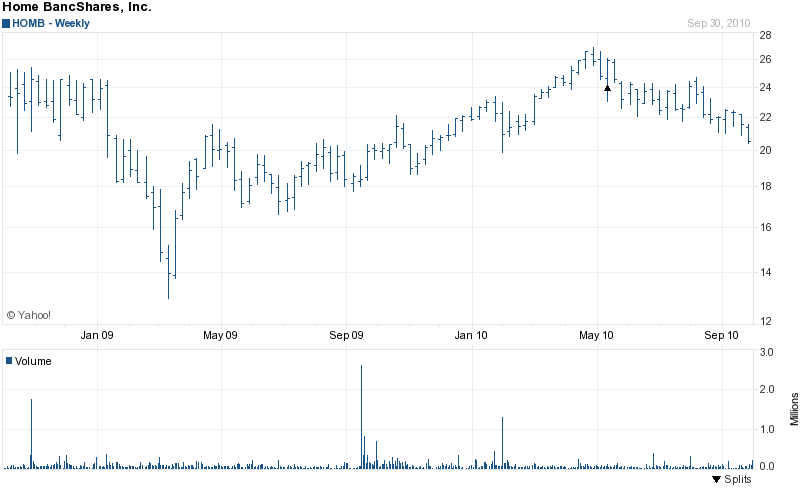

Home BancShares, Inc. of Conway, Arkansas, operates as the holding company for Centennial Bank. Founded in 1998, Home BancShares has grown rapidly through acquisitions and now has over $3 billion in asssets. Home BancShares has been profitable over the past three years and the company’s share value has recovered significantly from the lows of early 2009.

HOMB - COURTESY YAHOO FINANCE

Home BancShares, Inc received $50 million from the US Treasury under the TARP Capital Purchase Program (CPP) in January 2009. Home BancShares has been making the required dividend payments on the preferred shares owned by the US Treasury but has not repaid the original investment. The preferred shares under the CPP require that Home BancShares pay the US Treasury a 5% annual dividend which will increase to 9% after 5 years.

The 12 branches of failed Wakulla Bank will reopen on Monday as branches of Centennial Bank and depositors will have full access to their funds over the weekend. FDIC coverage on Wakulla deposits will continue.

Wakulla Bank had a troubled asset ratio of 229%, indicating a large amount of defaulted loans and non-accruing loans. Virtually all of the failed banks closed by regulators this year had a troubled asset ratio exceeding 100%. At June 30, 2010, Wakulla Bank had total assets of $424.1 million and total deposits of $386.3.

Centennial Bank did not pay a premium for the deposits of Wakulla Bank. The potential future losses on Wakulla assets purchased by Centennial Bank are limited under a loss-share agreement with the FDIC. The loss-share transaction covers $212.7 million or 50% of the assets purchased by Centennial. As noted in Home BancShares SEC filings, the two previous failed bank acquisitions resulted in an immediate large accretion to earnings and a substantial improvement in the efficiency ratio.

Our net income increased 86.9% to $21.8 million for the six-month period ended June 30, 2010, from $11.7 million for the same period in 2009. The $10.2 million increase in net income is primarily associated with an $9.3 million pre-tax gain on the first quarter 2010 FDIC-assisted acquisitions, $8.4 million of additional net interest income from a 27 basis point increase in net interest margin combined with the additional earning assets from our two FDIC-assisted transactions plus new income from FDIC indemnification accretion…

Our efficiency ratio was 45.68% for the six months ended June 30, 2010, compared to 62.40% for the same period in 2009. This positive progress was primarily due to the gains earned on acquisitions, our ability to raise net interest margin and the continued improvement of our overall operations. Excluding the $8.0 million pre-tax combined profit on the FDIC-assisted acquisitions and $245,000 of losses on OREO, our core efficiency ratio for the six-months ended June 30, 2010 would have been 49.69%.

Acquiring failed banks has been extremely profitable for many acquiring institutions, with some earning billions in profits due to FDIC assistance guarantees (see OneWest Makes Billions on Failed Banks and Insiders Reap Huge Profits on Failed Bank).

The estimated loss to the FDIC Deposit Insurance Fund for the failure of Wakulla Bank is estimated at $113.4 million or 26% of total assets. Wakulla is the nation’s 128th banking failure this year and the twenty-fifth in Florida, which leads the nation in banking failures.

Speak Your Mind

You must be logged in to post a comment.