Truman Bank, St. Louis, Missouri, a four branch bank with over a quarter billion dollars in assets, was closed today by the Missouri Division of Finance. The FDIC, appointed as receiver, sold the failed Bank to Simmons First National Bank, Pine Bluff, Arkansas, which will assume all deposits of Truman Bank.

Truman Bank, St. Louis, Missouri, a four branch bank with over a quarter billion dollars in assets, was closed today by the Missouri Division of Finance. The FDIC, appointed as receiver, sold the failed Bank to Simmons First National Bank, Pine Bluff, Arkansas, which will assume all deposits of Truman Bank.

Opened in 1994, Truman Bank became the 78th largest bank in Missouri but quickly ran into trouble as loan defaults started to soar in the wake of the financial crisis of 2008. By early 2009, the Bank’s troubled asset ratio exceeded 100% and at June 30, 2012, reached the untenable level of 384%. A high troubled asset ratio indicates a high percentage of nonperforming loans. Once a bank exceeds a troubled asset ratio of 100%, failure is usually inevitable, absent the infusion of new capital by investors.

Truman Bank had been under regulatory scrutiny as a problem bank for years. In December 2008 the Bank signed an Agreement with the Federal Reserve to improve managerial and business weaknesses and raise additional capital. Unable to provide regulators with an acceptable capital restoration plan, regulators had no choice but to close insolvent Truman Bank.

All four branches of Truman Bank will reopen as branches of Simmons First National Bank. All depositors of Truman Bank will automatically become depositors of Simmons with uninterrupted FDIC insurance coverage up to the applicable limits. Over the weekend, depositors of Truman Bank will have full access to their money through the use of checks, ATMs and debit cards.

Truman Bank had total assets of $282.3 million and total deposits of $245.7 million at June 30, 2012.

Simmons First National Bank agreed to purchase all of Truman Bank’s assets subject to a loss-share transaction with the FDIC covering $117.8 million of the asset pool acquired. Under the agreement, the FDIC will reimburse Simmons for 80% of losses on the failed bank’s assets. The FDIC maintains that keeping failed banking assets in the private sector minimizes losses and disruptions to loan customers.

In a press release, Simmons First National Bank summarized the details of the asset purchase agreement with the FDIC.

Of the $282 million in assets acquired, SFNB has entered into a purchase and assumption agreement with the FDIC to purchase $219 million in assets and assume substantially all of the deposits and other liabilities, at a discount of $20.9 million and no deposit premium. The remaining $63 million in assets acquired were through a loan sale agreement with the FDIC, at a 12% discount.

Prior to today’s acquisition, Simmons First acquired two other failed banks – Southwest Community Bank, Springfield, Missouri in May 2010 and Security Savings Bank, Olathe, Kansas in October 2010.

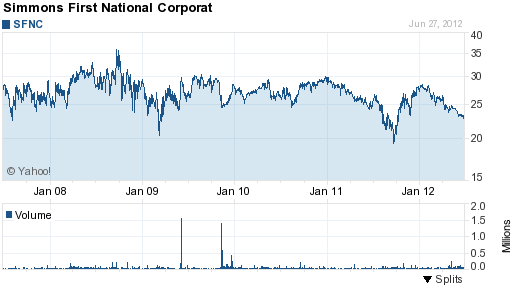

Simmons First National Corporation, the parent holding company for Simmons First National Bank, said that the acquisition of Truman Bank will “immediately” increase net income and earnings per share. Simmons First National is a well capitalized bank with approximately $3.3 billion in assets.

The loss to the FDIC Deposit Insurance Fund for the failure of Truman Bank is $34 million. Truman Bank is the nation’s 42nd bank failure of 2012 and the second in Missouri.

Speak Your Mind

You must be logged in to post a comment.