In its capacity as receiver for failed banks, the FDIC is responsible for either selling or winding down the operations of failed banks. In the vast majority of cases, the FDIC is able to sell a failed bank to a purchaser who agrees to purchase some or all of the assets of the failed institution.

In order to attract bids on failed banks, the FDIC agrees to absorb a large percentage of future losses on asset pools sold to purchasers of failed banks through the use of loss-share transactions. According to the FDIC, the use of loss-share transactions “maximizes returns of the assets by keeping them in the private sector”.

Despite the generous terms given to purchasers of failed banks under loss-share transactions, purchasers of failed banks often refuse to buy all of a failed bank’s assets. Purchasers may refuse to purchase certain failed bank assets due to a variety of reasons, including loan default or extremely poor collateral. As receiver, the FDIC retains any failed bank assets that it cannot sell, which are classified as “resolution receivables.” Over the past four years, the FDIC has accumulated a massive $30 billion portfolio of failed bank assets that it could not sell.

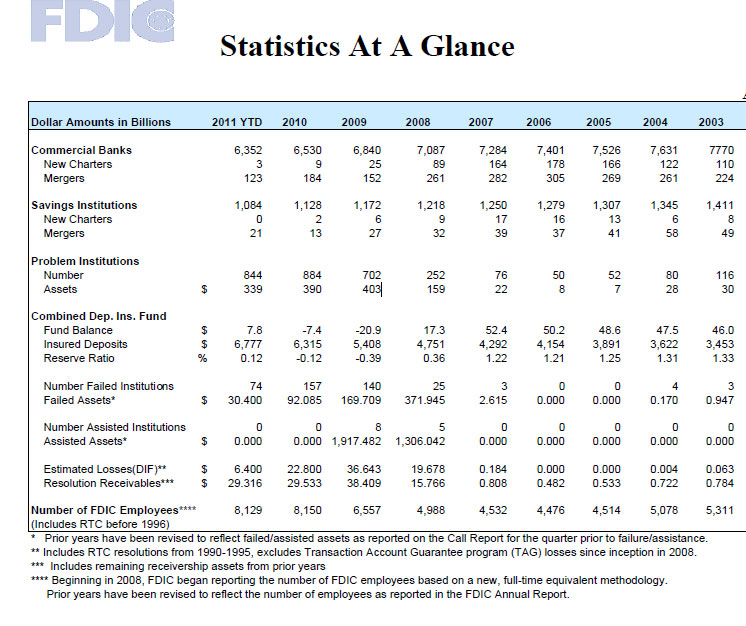

From nearly nothing in 2007, the FDIC’s mountain of junk failed bank assets swelled to $38.4 billion at September 30, 2009. Over the following year, the FDIC reduced this amount to $29.5 billion but has since made little progress in reducing its portfolio of failed bank assets. Despite the fact that the FDIC was able to sell the vast majority of assets held by the 92 banks that failed during 2011, the resolution receivables balance declined by only $200 million to $29.3 billion as of the last reporting period ending September 30, 2011.

For perspective on the size of the failed banking assets held by the FDIC consider the following comparisons.

- Total assets of the 92 banks that failed during 2011 totaled $36 billion.

- The FDIC Deposit Insurance Fund (DIF) currently has a balance of only $7.8 billion which provides insurance protection on a staggering $6.78 trillion in deposits.

The only reason that the FDIC would retain a mountain of failed bank assets is because they are of such poor quality that they cannot be sold without occurring significant losses. Although the FDIC’s estimate of losses on assets of a failed bank is taken into account when the bank fails, a weak economy and continuing declines in residential and commercial real estate values have almost certainly eroded the value of failed banking assets held by the FDIC.

The decline of residential real estate values has been relentless since 2007 and the Wall Street Journal reports this week that the commercial office market is weakening significantly.

Defaults and foreclosures are rising. The delinquency rate of office loans that were securitized hit 9% in December, up from 7.4% in June.

Rents in most markets are still well below what they were in 2007, with the drop in some areas as much as 26%…

If the FDIC could sell their massive portfolio of failed bank assets at anything near carrying value they would. However, with a severely depleted Deposit Insurance Fund, the FDIC cannot afford to take large losses by dumping resolution receivables at market prices. The FDIC is playing the same “extend and pretend” game as the banks, hoping that property values recovery while avoiding the recognition of losses that in reality already exist.

When the FDIC is able to sell failed bank assets, it is usually at a very steep discount to unpaid principal balance of the loans involved. In addition, the FDIC often provides very low rate financing for the purchaser and retains a large interest in the asset pool “sold”.

The latest sale of resolution receivables reported today by the FDIC involved a small pool of assets with an unpaid principal balance of $101 million. A 25% interest in the loan pool involved was sold at a discount of 46% to unpaid principal. The FDIC retained the other 75% of the asset pool and received a cash payment of only $13.6 million from the purchaser, according to the FDIC press release.

The Federal Deposit Insurance Corporation (FDIC) has closed on the third sale in its Small Investor Program (SIP). The competitive bidding process involved the sale of a 25 percent initial equity stake in a limited liability company (LLC) formed by the FDIC in its receivership capacity to hold certain loans of the Bank of Whitman, Colfax, Washington, which failed on August 5, 2011.

The loans transferred to the LLC consisted of 62 performing and non-performing commercial real estate loans, commercial acquisition and development and construction loans, as well as performing and non-performing residential acquisition, development and construction loans. The collateral is located primarily in Washington, Idaho and Utah, and has an aggregated unpaid principal balance (UPB) of $101,007,866.

The purchaser of the initial equity stake in the LLC was Mariner Real Estate Partners III, LLC, Leawood, Kansas, which is a minority-owned business.

Mariner paid approximately $13.6 million (net of working capital) in cash for its initial 25 percent stake in the LLC; its bid valued the loans at approximately 54 percent of the aggregate UPB. Mariner will provide for the management, servicing and ultimate disposition of the LLC’s loans.

Without considering additional failed bank assets that the FDIC may be forced to acquire from future failed banks, it will be decades before the FDIC disposes of its vast portfolio of failed bank assets.

The FDIC’s also been securitizing these assets, and sells pools of the loans to private investors on a fairly regular basis. Check the Asset Sales portion of their Web site.

As Bankers it is our job to let depositors know that their money is in the best of hands..In order to do so we need to have a firm foundation and secure way of investing their money….I have been in the mortgage Industry for over 25 years..I have seen the change and how it has affected all of us. We need to put a handle on it…The best way to do this is to take all of the foreclosures properties and put them in a program ( not a loan modification) A secure educational equity program..which I will call @ this time..(American Equity educational securitization)…that allows the borrower to help themself by saving the property and also allowing them to sell if no equity is available….In this program, the homeowner is allowed to sell only if they know they cannot and will not make the payments….If the homeowner does not have the money that is a different story..sometimes hardship comes but in some cases the homeowner is just having problems refinancing because of credit. Some homeowners have equity in their property and can help themselves…Appraisals are down now..who knows what is the real market price…Look at your BPO’s it will tell you…I am from Los Angeles, CA I can tell you from every BPO in the area what a house is really worth…Let us as bankers..give a little dont make it so difficult for individuals whether the are in business or not to obtain the financing that is so needed….America is the best place in the world to be…I love America…..and I have a special love for our soilders who fight for our country…..God has always given us a

special heart to help others so let us as bankers walk in that light that we are called to walk in and pray that we continue to help others out of their temporary dilema. As our soliders come home their families may even be facing foreclosures..Let us be more compassionate to the needs of others….When it really boils down to the it….. we will do what is best for our own………no matter what the cost………….God bless you!

Ms. Garrett, you stated that “who knows what is the real price”, and then you tell us “from looking at BPO you can tell us what a house is really worth”.

Isn’t that contradictory? It really makes no difference what you think a house is worth, that I can see. This is not going to solve the problem.

In my opinion, it is good that you are suggesting a resolution, but I cannot see a specific statement as to how anything will be resolved. New financing only transfers an existing problem if the owner cannot pay. Also, I’m a little fuzzy on the “educational” part of the title.