July 30, 2010 – The Cowlitz Bank, Longview, Washington, was closed today by the Washington Department of Financial Institutions. The FDIC, as receiver, entered into an agreement with Heritage Bank, Olympia, Washington, to assume all deposits and some of the assets of failed Cowlitz Bank.

The Cowlitz Bank had a total of nine branches, including two in Oregon and three in Washington under the name Bay Bank, which is a division of The Cowlitz Bank. All Cowlitz branches will reopen as branches of Heritage Bank.

Brian Vance, the President and CEO of Heritage Financial Corporation, the parent company of Heritage Bank, said “We are pleased to welcome the customers and employees of Cowlitz Bank and Bay Bank to the Heritage Bank family, and we want to assure depositors that they are banking with an exceptionally strong financial institution”. Unmentioned by Mr. Vance is the fact that Heritage Financial Corporation still owes the US Treasury $24 million which was disbursed to the bank under the TARP Capital Purchase Program (commonly referred to as the bank bailout program).

Heritage Financial Corp ((NASDAQ: HFWA) does seem to be turning the corner financially, reporting first quarter net income of $365,000 compared to a loss of $923,000 the previous year, although much of the earnings increase came from a decreased provision for loan losses. CEO Vance expressed optimism for future operating results but also noted that the local economy still presented challenges: “The housing sector continues to show weakness in the Pacific Northwest, especially in the land development area. There has been some localized improvement in single family housing sales, however, and subsequent reduced inventories of homes for sale”.

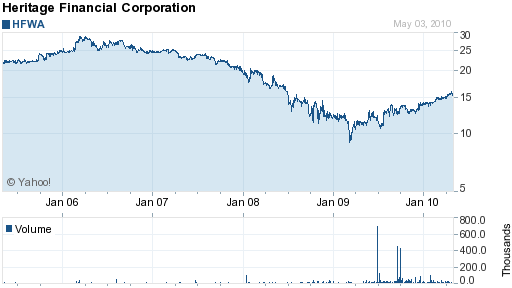

The recent recovery in the stock price of Heritage Financial would seem to indicate that investors see a brighter future.

Courtesy Yahoo Finance - HFWA

Speak Your Mind

You must be logged in to post a comment.