The $700 billion Troubled Asset Relief Program (TARP) that was authorized in 2008 to bailout failing financial institutions is still in the process of being wound down. The latest report from the Government Accounting Office (GAO) (which is required by law to report on TARP every 60 days) reveals that the U.S. Treasury is still keeping hundreds of problem banks on life support.

Originally, 707 troubled financial institutions received TARP bailouts. As of September 30, 2011, 390 institutions remain in the TARP program, including approximately 370 banks which have still not been able to repay loans funded by the U.S. taxpayer.

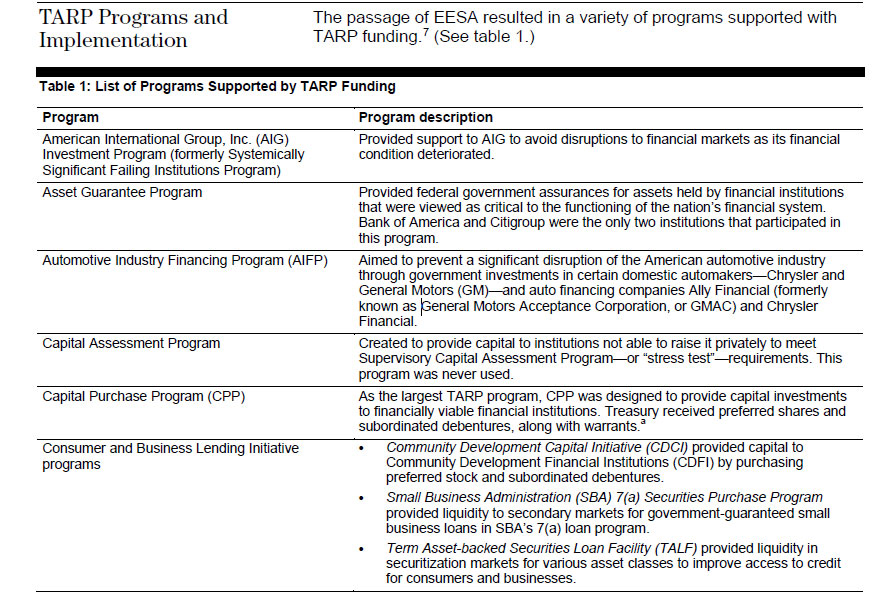

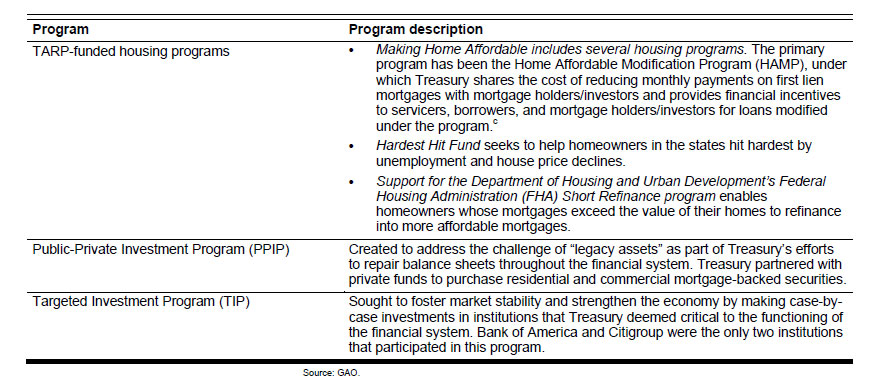

TARP, generally associated with bank bailouts, was also used to fund a variety of other bailout programs as seen below.

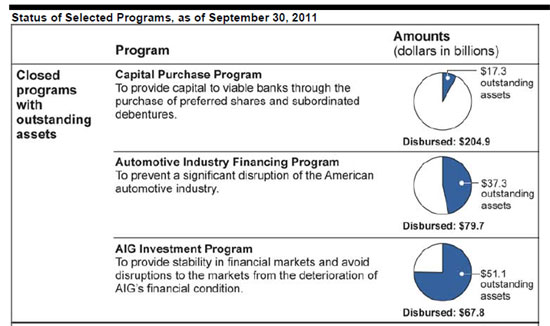

Although bank bailouts originally accounted for the largest TARP disbursements, most of the funds lent to the banking industry have been repaid. Total TARP bailout funds disbursed to banks totaled $204.9 billion of which $17.3 billion remains outstanding.

The outstanding TARP loans are concentrated in a relatively small group of banks. The 25 banks with the largest outstanding TARP loans owe $11.3 billion or 65% of the $17.3 billion dollars still owed. The largest outstanding amount was $3.5 billion. The U.S. Treasury received preferred stock in the banks under the Capital Purchase Program in exchange for TARP money, effectively turning U.S. taxpayers into investors in some of the weakest banks in the country.

Although TARP is commonly associated only with the banking industry, most of TARP loans that remain outstanding are due from the automobile industry and insurance giant AIG. Total bailout funds provided to AIG and the auto industry totaled $147.5 billion of which $88.4 billion remains unpaid. The GAO estimates that the losses on TARP will total a staggering $23 billion in fiscal 2012, primarily due to losses on investments in American International Group (AIG) and General Motors (GM). In addition, the GAO said that the ultimate resolution of the TARP mess could take another five years or longer.

According to the January 2012 report from the GAO, the U.S. Treasury’s strategy for winding down TARP programs is as follows:

Treasury has articulated broad principles for exiting TARP, including exiting TARP programs as soon as practicable and seeking to maximize taxpayer returns, goals that at times conflict. Some of the programs that Treasury continues to unwind, such as investments in American International Group, Inc. (AIG), require Treasury to actively manage the timing of its exit as it balances its competing goals. For other programs, such as the Capital Purchase Program (CPP)—which was created to provide capital to financial institutions—Treasury’s exit will be driven primarily by the financial condition of the participating institutions. Consequently, the timing of Treasury’s exit from TARP remains uncertain.

The banks still indebted to the U.S. Treasury under TARP are problem banks that have little likelihood of ever recovering. The majority of banks owing TARP funds are not even able to make the required interest payments on their loans. Nonetheless, regulators have allowed many weak or insolvent banks to remain open that in the past would have already been closed (see Regulators Let Zombie Banks Remain Open).

Unless the economy suddenly starts booming, most of the problem banks that owe $17.3 billion in TARP money could eventually fail, resulting in substantial losses to the taxpayers. For example, Flagstar Bancorp owes the U.S. Treasury $267 million and has been unable to make scheduled payments on the debt. Flagstar lost $45 million in its last reported quarter and its stock trades at only 73 cents a share, not exactly a sign of confidence by investors.

The ultimate loss to taxpayers on the $17.3 billion in unpaid TARP funds could be significant. By comparison, the loss to the FDIC Deposit Insurance Fund for the 92 bank failures during 2011 amounted to $7.2 billion.

With 844 banks on the FDIC Problem Bank List and $17.3 billion at risk from outstanding TARP loans, losses on failed banks are likely to continue for many years.

Speak Your Mind

You must be logged in to post a comment.