Bank failures don’t come much smaller than today’s closing of Pisgah Community Bank, Asheville, N.C. Total assets at Pisgah amounted to only $21.9 million, smaller than what many of the top executives take home in a year at the “too big to fail” banks. Pisgah Community Bank was established on May 15, 2008 on the […]

Will the Failure of Pisgah Community Bank Trigger the Collapse of 10 Related Banks?

Number of Banks on FDIC Problem Bank List Remains Historically High

The number of banks on the FDIC Problem Bank List declined for the seventh consecutive quarter. According to the latest FDIC Quarterly Banking Profile, the number of problem banks as of December 31, 2012, declined to 651 from 694 in the previous quarter. Despite significant recovery in the banking industry, the number of problem banks […]

2012 Bank Failures Lowest Since 2008 As Regulators Close 51 Banks

During the past five years we have witnessed the greatest financial turmoil since the Great Depression. Hundreds of giant bank failures rocked the nation, real estate values crashed, trillions of dollars of wealth vanished overnight and millions of Americans lost their jobs. Although a relative calm has been restored due to unprecedented actions by both […]

Citizens First National Bank, IL, Founded In 1865, Closed By Regulators

One of the country’s oldest banks, Citizens First National Bank, Princeton, IL, was closed today by the Comptroller of the Currency. The FDIC, acting as receiver, sold the failed bank to Heartland Bank and Trust Company, Bloomington, IL. Citizens First National, a large bank with 21 branches and almost $1 billion in assets, becomes the […]

Banks Desperate For Funds Victimized By Con Men

This post should trigger a snicker from many consumers who feel that they are victims of the banking industry. In a new twist, banks themselves are now at the top of the list for many con men One would think that with the increased regulatory scrutiny of the banking industry, banks would be last on […]

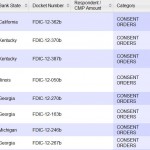

Five Bank Failures Bring Year’s Total To 38 – FDIC Losses Top $1.9 Billion

Regulators had a busy week closing five banks in four different states on Friday. Although bank failures have been proceeding at a slower pace than last year, the total losses to the FDIC Deposit Insurance Fund now top $1.9 billion and the number of problem banks remains very high considering that we are four years […]