The latest national housing survey conducted by Fannie Mae shows that many Americans expect to see both higher mortgage rates and rising home prices over the next year. It will be interesting to see how this paradox unfolds since an increase in mortgage rates has typically made housing less affordable to buyers. One scenario under […]

Almost Half of Americans Expect Higher Mortgage Rates and Higher Home Prices

Freddie Mac Stock Jumps On Earnings – What’s Next For Shareholders?

Freddie Mac (FMCC), the government sponsored agency that backs mortgage loans for millions of American home buyers reported all time record annual profit of $11 billion for 2012. Freddie Mac has been in the black now for five consecutive quarters as the housing market improves and loan delinquencies decrease. Freddie Mac has been operating under […]

FHA Reverse Mortgage Losses Of $28 Billion – Profits For Banks, Disaster For Borrowers and Taxpayers

Reverse mortgages have become the new minefield in government sponsored mortgage lending. According to an independent estimate done for HUD, losses could exceed $28 billion through 2019. To put that figure into perspective, total losses to the FDIC Deposit Insurance Fund for the 51 banking failures of 2012 total only $2.5 billion. The good news […]

FHA Loans Immediately Put Borrowers Into A Negative Equity Position

In a speech given at the Brookings Institution, Brian Moynihan, CEO at Bank of America, said “We need to look hard at some of the old assumptions and ask the question is homeownership the right solution for everyone?” Moynihan went on to cite the Federal Housing Administration (FHA) as an example of what is wrong […]

Housing Market Unlikely To Boost Economic Recovery In 2013

Although the economy grew in the third quarter, data continues to show a “sluggish recovery overall” according to Fannie Mae’s Economic & Strategic Research Group. Total growth in U.S. gross domestic product since the lows of 2009 has been 7.2% compared with average growth of 16% for previous economic recoveries since the 1960’s. Despite the […]

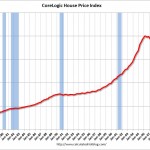

Group Think On Housing Recovery May Be Premature

Almost daily the mainstream news media is proclaiming that the housing crisis is over. A recent Wall Street Journal front page article boldly proclaimed “The Housing Bust Is Over.” No less an authority than Warren Buffett has suggested that housing has become a compelling investment opportunity. Tops and bottoms in any market are not usually […]

Interest Rates At All Time Lows And Home Prices At Ten Year Lows – Why Are Home Sales The Worst Ever?

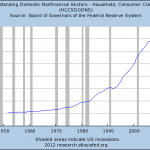

In Federal Reserve Chairman Ben Bernanke’s world, all he had to do was lower interest rates enough and housing prices would magically re-inflate. Wrong! Mortgage rates are at all time lows, home prices are at 2002 levels and owning a home is just as cheap as renting, yet the housing market remains mired in a […]

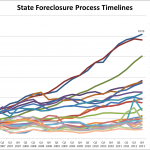

Widespread Banking Failures Predicted As Housing Values Continue To Plummet

According to Micheal Olenick, founder of FindtheFraud, the worst of the housing crash and banking crisis still lies ahead of us. Mr. Olenick’s excellent in depth analysis discusses the multiple factors that are prolonging the foreclosure crisis and explains how banks and servicers are trying to delay taking losses that could eventually reach a staggering […]

Everyone and No One Is In Charge Of Fixing The Housing Crisis

The housing crisis is widely viewed as the biggest impediment to economic recovery. Despite the expenditure of trillions of dollars in financial support from the Federal Reserve and other government agencies, housing prices continue to decline. In addition, the wide ranging regulatory overhaul of banking and mortgage practices being implemented under the Dodd-Frank Act, is […]

Total 2011 Foreclosure Filings Reach 2.7 Million – Expect 2012 To Be Worse

Fed Chairman Ben Bernanke must be talking to himself by now. Despite driving interest rates to zero and the expenditure of trillions of dollars to prop up the housing market, home prices declined again in 2011. The most recent data on foreclosure activity makes it clear that the Fed’s efforts to date have accomplished next […]