The goal of the Volcker Rule, which became law under the Dodd-Frank Act was to restrict speculative trading activity in risky derivatives by the Too Big To Fail Banks. The ban on proprietary bank trading was proposed by former Federal Reserve Chairman Paul Volcker who believed that one of the primary causes of the 2008 […]

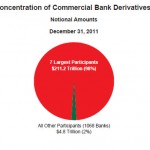

Banks Amass $211 Trillion In Derivatives, JP Morgan Loses $2 Billion And Volcher Rule Debates Continue

Banking News – Daily Banking Update

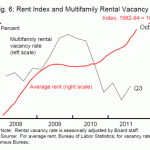

Welcome to Banking Update, a roundup of articles and news from around the Internet. Banks continue to be sued for selling defective mortgages, the Fed says a housing recovery is essential for economic recovery, Americans still believe owning a home is part of the “American dream”, banks are still engaged in risky behavior, savings rates […]

FDIC To Cover Losses On $75 Trillion Bank of America Derivative Bets

Potential losses on Bank of America’s massive $75 trillion book of risky derivative contracts has just been dumped onto the FDIC by the Federal Reserve. Derivatives, once described by Warren Buffet as “financial weapons of mass destruction” are complex contracts entered into for speculation or to hedge risks linked to a wide variety of other […]