The goal of the Volcker Rule, which became law under the Dodd-Frank Act was to restrict speculative trading activity in risky derivatives by the Too Big To Fail Banks. The ban on proprietary bank trading was proposed by former Federal Reserve Chairman Paul Volcker who believed that one of the primary causes of the 2008 […]

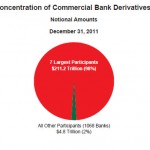

Banks Amass $211 Trillion In Derivatives, JP Morgan Loses $2 Billion And Volcher Rule Debates Continue

Too Big To Fail Casino Banks Make $518 Billion Bet On PIIGS Sovereign Debt

The “Too Big To Fail Banks” are at it again, making huge speculative bets on the odds of sovereign default by Portugal, Italy, Ireland, Greece and Spain. The costly lessons of the derivatives debacle of 2008 have apparently been forgotten. In 2008, the Too Big To Fail banks bought massive amounts of credit default swaps […]

Bank Of America Derivatives Timebomb Shows System Is Corrupt To The Core

The Federal Reserve recently allowed Bank of America to move its massive derivative positions from the bank holding company to its banking subsidiary which is an FDIC insured depository institution. By allowing this transfer, the Federal Reserve has allowed Bank of America to shift the risk of loss on speculative derivative contracts from the non-bank […]

FDIC To Cover Losses On $75 Trillion Bank of America Derivative Bets

Potential losses on Bank of America’s massive $75 trillion book of risky derivative contracts has just been dumped onto the FDIC by the Federal Reserve. Derivatives, once described by Warren Buffet as “financial weapons of mass destruction” are complex contracts entered into for speculation or to hedge risks linked to a wide variety of other […]