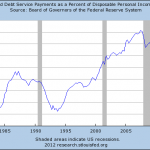

Bold actions by the Federal Reserve to smash interest rates to historically low levels were undertaken to reduce the burden of debt payments on consumers and businesses. The dramatic drop in interest rates since 2008, as well as a more cautious attitude towards debt by consumers, has resulted in lowering the household debt service ratio […]

Banking Update – Daily Banking News

Welcome to Banking Update, a roundup of articles and news from around the internet. News Highlights of the Day: The European banking and sovereign debt crisis continues to confound the ability of policy makers to contain the crisis and the risk of financial contagion to the U.S. banking system remains a serious concern. Did Fed […]

Net Worth of American Households Plunges By $2.4 Trillion In Third Quarter

Those looking for a rebound in either real estate prices or the wealth of the American consumer were sorely disappointed after the release of the Federal Reserve’s Flow of Funds Accounts for the third quarter 2011. The net worth of Americans plunged by $2.4 trillion in the third quarter. Keep in mind that the entire […]

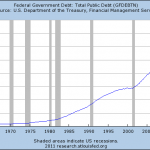

S&P Downgrades US Debt – Feds Tell Banks US Securities Still “Riskless”

The credit rating of the United States was downgraded for the first time in its history by Standard & Poor’s. The credit rating agencies had previously warned Congress that unless a credible deficit reduction plan was enacted, the United States could expect a downgrade. Standard & Poor’s reduced the US credit rating from AAA to […]