Sun Security Bank, Ellington, Missouri, was closed today by state regulators and the FDIC was appointed as receiver. The failed bank, which had 27 branches across Southern Missouri, became the State’s first banking failure of 2011. The last banking failure in Missouri occurred on October 15, 2010.

The FDIC sold Sun Security to Great Southern Bank, Springfield, MO, which will assume all deposits of the failed bank to protect depositors. All branches of Sun Security will reopen on Saturday as branches of Great Southern and depositors will have full access to their money over the weekend through check writing or by using debit cards or ATM.

Sun Security, established in 1970, experienced a large number of defaulting loans as the value of real estate declined. The Bank’s troubled asset ratio climbed above 300% and efforts to raise additional capital were unsuccessful. Regulators place Sun Security under heightened regulatory scrutiny and issued the Bank a cease and desist order in April 2008, citing numerous managerial and financial weaknesses.

At June 30, 2011, Sun Security had total assets of $355.9 million and total deposits of $290.4 million.

Great Southern Bank agreed to acquire all of the assets of failed Sun Security. The exceptionally low quality of Sun Security’s loan portfolio was exhibited by the unusually large amount of assets that are covered under the loss-share agreement between the FDIC and Great Southern. Typically, the FDIC has been providing loss protection on 80% or less of the asset pool acquired by a purchaser of a failed bank.

In the case of Sun Security, the FDIC loss-share agreement with Great Southern Bank covers $351.9 million or 99% of the asset pool acquired and requires the FDIC to cover 80% of the losses on covered loans. The amount of the loss the FDIC is taking on the failure of Sun Security is also much higher than usual. The average loss, as a percentage of total assets, for the banking failures that occurred during 2011 is 20%. The loss to the FDIC on the failure of Sun Security amounts to $118.3 million or 33% of total assets.

In a press release, Great Southern Bank assured Sun Security customers about the safety of their deposits and forecast that the acquisition of Sun Security should be accretive to earnings.

“We welcome Sun Security Bank customers and employees to Great Southern. Customers can be confident that their deposits are safe and readily accessible. It’s business as usual,” said Great Southern President and CEO Joseph W. Turner. “Great Southern has served Missouri customers’ financial needs for 88 years with a deep commitment to building winning relationships.”

Great Southern will be assuming approximately $287 million of deposits of Sun Security Bank at no premium. Additionally, Great Southern is purchasing approximately $245 million in loans and $35 million of other real estate owned (ORE) at a discount of $55 million. The loans (excluding approximately $4 million of consumer loans) and ORE purchased are covered by a loss sharing agreement between the FDIC and Great Southern.

Under this agreement, the FDIC has agreed to cover 80% of the losses on the covered loans and ORE. In addition, Great Southern will also be purchasing cash and certain marketable securities of Sun Security Bank. The Company anticipates recording this transaction under ASC 805 – Business Combinations, in the quarter ending December 31, 2011. The financial statement effects of this transaction will be disclosed at a later date upon completion of further review and analysis, but the Company anticipates that this transaction will be accretive to income and equity beginning in the current quarter.

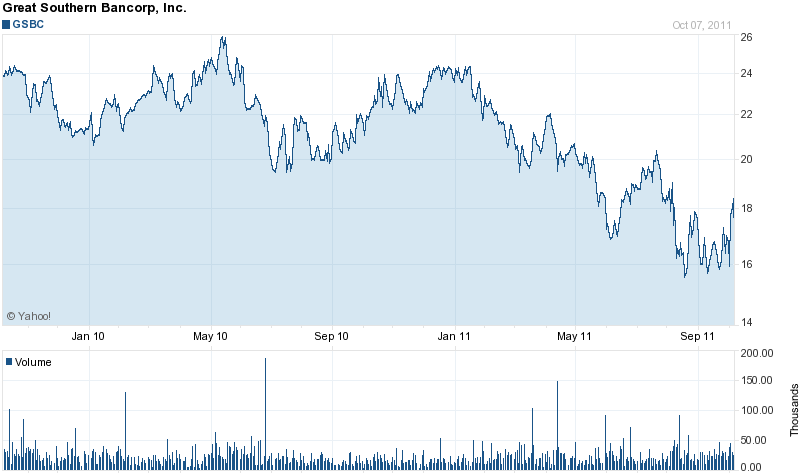

Great Southern Bank was founded in 1923, has $3.4 billion in assets and operates 76 banking centers in five states. The purchase of Sun Security represents the third failed bank acquisition by Great Southern since 2009. The holding company for Great Southern is Great Southern Bancorp which has seen its stock price plunge this year as concerns mount over the health of the banking system.

Sun Security is the 76th banking failure of the year and the first in Missouri. The loss to the FDIC Deposit Insurance Fund for the failure of Sun Security is $118.3 million.

Speak Your Mind

You must be logged in to post a comment.