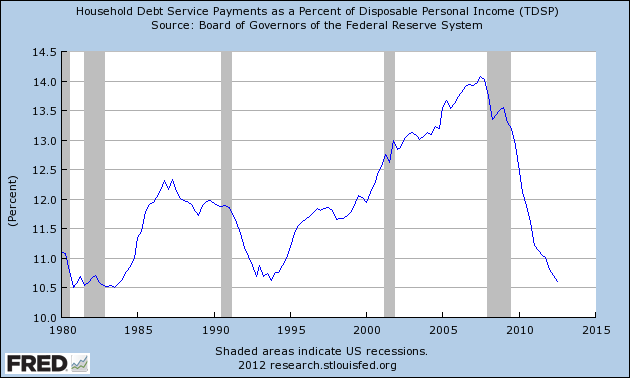

Bold actions by the Federal Reserve to smash interest rates to historically low levels were undertaken to reduce the burden of debt payments on consumers and businesses.

The dramatic drop in interest rates since 2008, as well as a more cautious attitude towards debt by consumers, has resulted in lowering the household debt service ratio to levels last seen in 1983. Lower debt ratios mean that consumers can more easily take on additional debt for spending which, in turn, contributes to increased economic growth.

According to the latest reports from the Federal Reserve, the U.S. household debt-service ratio has declined from 14.1% in 2008 to 10.6% at the end of September 2012. Since consumer spending accounts for approximately 70% of U.S. gross domestic product, the ability to borrow and spend lays the groundwork for faster economic growth.

The Federal Reserve’s unprecedented actions to suppress interest rates, while devastating to savers, has allowed cheap credit to lower monthly debt payments. Short term, the Fed’s policies of low interest rates are helping the economy and consumers. Longer term, major structural problems could short circuit future growth. Members of the Federal Reserve are already openly discussing the drawbacks of unlimited monetary stimulus and some economists predict that the Fed may have to increase interest rates sooner than expected.

While the Fed has reduced monthly payments for debtors, the fundamental problems of too much debt and too little income will be major long term impediments to sustained economic growth. Consumers lack confidence in the future, which is why banks are struggling to increase loan growth. Those who can borrow don’t want to and those who need to borrow are qualified.

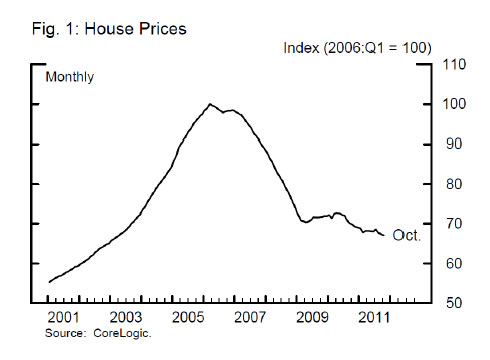

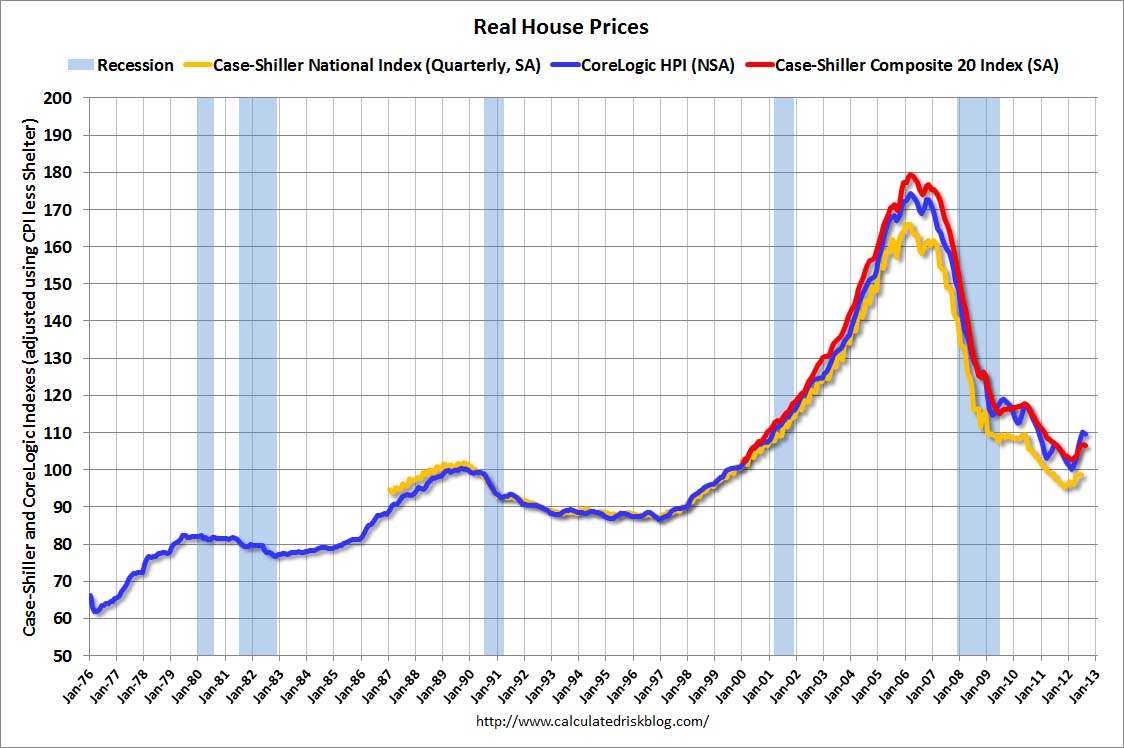

Interest rates will not stay low forever and five years after the debt crisis of 2008, total debt has not declined perceptibly. Debt remains as big a problem as ever. According to the Federal Reserve, total mortgage debt on 1 – 4 family dwellings totaled $11.1 trillion in 2008. By the third quarter of 2012, total mortgage debt had declined by only 10% to $9.9 trillion, with most of the decrease due to defaults and write offs by banks.

Debt remains as big a problem as ever, even as the underlying asset values used to collateralize the debt remains dramatically depressed. By any measure, home values remain far below the levels of six years ago. While the value of home equity has disappeared, most of the debt remains.

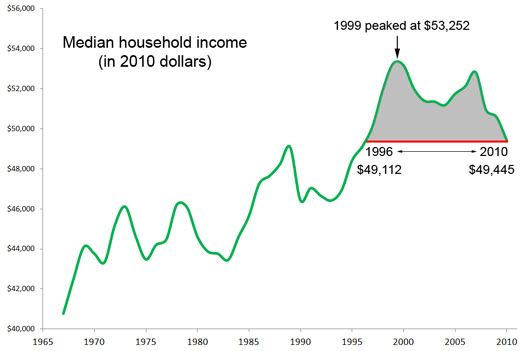

Absent very robust income growth or a permanent state of zero interest rates, the struggle to de-leverage will continue to impede consumer exuberance. Lower interest rates are only a temporary band aid. Without increased jobs and income growth, the problem of too much debt will become increasingly difficult to conquer. Unfortunately, as any one working for a living knows, raises are small or nonexistent and household income has been declining for over a decade.

Many Americans face a lower standard of living as the economy continues to struggle with fundamental structural problems. Low rates have helped to an extent, but they are treating the symptoms and not the disease. We don’t need more cheap debt Mr. Bernanke and Mr. President – we need real growth in incomes and job opportunities.

Speak Your Mind

You must be logged in to post a comment.