A small Colorado bank became the nation’s 51st banking failure. Signature Bank, Windsor, CO, was closed by the Colorado Division of Banking. The FDIC, acting as receiver, sold the Bank to Points West Community Bank, Colorado.

Signature Bank had three branches which will reopen as branches of Points West. Depositors will have full access to their funds over the weekend through the use of checking accounts, ATMs and debit cards.

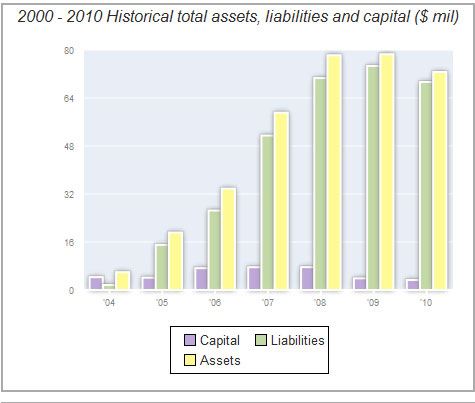

Signature Bank was established in December, 2004, just in time to join the banking party that resulted from the real estate mania of the late 2000’s. During the boom years leading up to the real estate meltdown, Signature Bank rapidly expanded its lending in an overheated market. Assets peaked at $80 million in 2008, coinciding with the top in real estate. The subsequent financial crisis which popped the real estate bubble also sealed the fate of Signature Bank.

Apparently, Signature Bank executives were still searching for investors to bail them out right up until they failed. The Signature Bank website, under the “Investor Information” section states that “Signature Bank is currently placing potential investors on a waiting list”.

At March 31, 2011, Signature Bank had total assets of $66.7 million and total deposits of $64.5 million. Points West agreed to assume all of Signature’s deposits and purchase all of its assets.

The cost to the FDIC for the failure of Signature Bank is $22.3 million or 33% of total assets. Signature becomes the nation’s 51st banking failure and the 4th in Colorado. Regulators also closed another Colorado Bank today, Colorado Capital Bank.

Speak Your Mind

You must be logged in to post a comment.