Putnam State Bank, Palatka, FL, established in December 1988, was closed today by the Florida Office of Financial Regulation. The FDIC, appointed as receiver for the failed bank, was able to sell Putnam State Bank to Harbor Community Bank, Indiantown, FL.

Putnam State Bank, Palatka, FL, established in December 1988, was closed today by the Florida Office of Financial Regulation. The FDIC, appointed as receiver for the failed bank, was able to sell Putnam State Bank to Harbor Community Bank, Indiantown, FL.

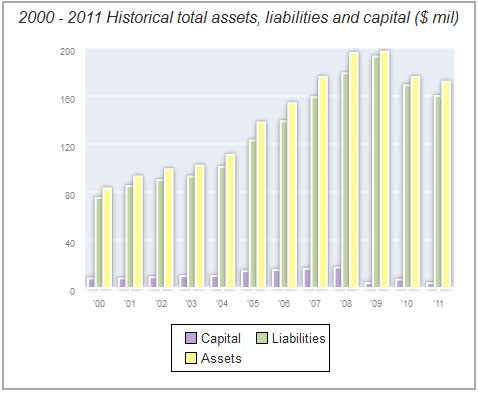

During the height of the real estate mania and lending boom, few states saw real estate values rise as rapidly as they did in Florida. Putnam State Bank expanded their lending activity at a torrid pace during the bubble years. From 2000 through 2008, Putnam State Bank increased total assets from approximately $80 million to almost $200 million.

As real estate values began to crash in 2008, many of the Bank’s borrowers were unable to make their loan payments and the amount of nonperforming loans soared. By the end of 2009, Putnam State Bank’s troubled asset ratio rose to almost 200% and by March 31, 2012 reached an astronomical 510%. Almost without exception, once a bank’s troubled asset ratio rises above 100%, bank failure becomes virtually inevitable.

While the number of problem banks remains historically high, regulators are allowing seriously undercapitalized banks to remain open for long periods of time. As previously discussed in Regulators Let Zombie Banks Remain Open, the Government Accountability Office has stated that “regulators had been inconsistent and often hadn’t acted quickly enough in addressing signs of banks’ deterioration.”

In response, regulators say that they want to give problem banks enough time to be able to raise additional capital. The problem with regulatory latitude becomes manifest when confronted by the fact that very few investors view investing in troubled banks as an attractive investment. Increasing capital via increased earnings has also become a low probability event based on low or nonexistent loan growth, the increased cost of regulatory burdens and an economy that appears to sliding back towards recession.

Putnam State Bank - courtesy faqs.org

All three branches of Putnam State Bank will reopen on Saturday as branches of Harbor Community Bank. All depositors of Putnam State Bank will automatically become depositors of Harbor Community with full FDIC deposit insurance in place up to the applicable limits.

Customers of Putnam State Bank will have access to their money over the weekend through the use of checks, debit cards and ATMs.

In addition to assuming all of Putnam State Bank’s deposits, Harbor Community Bank will also purchase all of the failed bank’s assets. At March 31, 2012, Putnam State Bank had total deposits of $160.0 million and total assets of $169.5 million. As part of the purchase agreement between the FDIC and Harbor Community, the FDIC will share in losses on the asset pool acquired by Harbor Community. The loss-share agreement between the FDIC and Harbor Community Bank covers $112.3 million of the assets acquired from failed Putnam State Bank.

The FDIC uses loss-share agreements as a sales inducement to purchasers of failed banks. In addition, the FDIC maintains that losses on failed banking assets are minimized by keeping the assets in the private sector.

Harbor Community Bank, founded over 50 years ago, has five branches in Florida and over $180 million in assets. The acquisition of Putnam State Bank was the first acquisition of a failed bank by Harbor Community.

The estimated loss to the FDIC deposit insurance fund for the failure of Putnam State Bank is $37.4 million or 22% of total assets. Putnam State Bank becomes the nation’s 29th banking failure of 2012 and the fourth in Florida.

Speak Your Mind

You must be logged in to post a comment.