One “tiny little error” resulted in red faces at both Bank of America (BAC) and the Federal Reserve when bank officials disclosed they had incorrectly calculated capital levels required for the annual stress tests. The Fed apparently did not notice the error until Bank of America notified them.

One “tiny little error” resulted in red faces at both Bank of America (BAC) and the Federal Reserve when bank officials disclosed they had incorrectly calculated capital levels required for the annual stress tests. The Fed apparently did not notice the error until Bank of America notified them.

This would all be very funny except for the fact that shareholders saw the value of their shares in Bank of America pulverized by a six percent decline and plans for a stock buyback and dividend increase were suspended.

As reported by Bloomberg BofA Drops After Stress-Test Error Halts Payout Increase.

Bank of America Corp fell the most since November 2012 after suspending plans for a dividend increase and $4 billion of share repurchases because of an error in its stress-test submission to the Federal Reserve.

The lender will resubmit its proposal after finding botched accounting on structured notes issued by Merrill Lynch, the Charlotte, North Carolina-based company said today in a statement. The stock tumbled 6.3 percent to $14.95 in New York, erasing a gain for 2014.

Chief Executive Officer Brian T. Moynihan had been set to quintuple the quarterly payout to 5 cents a share, five years after the second-biggest U.S. bank cut the dividend to a token amount during the financial crisis. Bank of America said its revised proposal probably will mean lower payouts than requested in its existing plan, which was already modified once to win Fed approval.

“Bank of America is by far not the first big bank to make a mistake in its CCAR submission,” David Hilder, an analyst at Drexel Hamilton LLC in New York, said in a phone interview, referring to the Fed’s Comprehensive Capital Analysis and Review. He said that while Bank of America noticed the error and probably has sufficient capital to cover the payout, the setback is “embarrassing” for the company.

The stock’s drop was overdone and “too punitive” in view of the company’s high capital levels, wrote Betsy Graseck, Morgan Stanley’s banking analyst, who has a buy recommendation on the shares with a $20 price target. Graseck said she’s assuming Bank of America will eliminate its buyback request while keeping the higher dividend. Mike Mayo at CLSA Ltd., who recommends selling the stock, said the incident “reflects unfavorably on controls” at Bank of America.

The error is another setback for Moynihan in his effort to increase dividends as shareholders clamor for income amid low yields from other investments. In March 2011, the Fed blocked plans for a boost just months after Moynihan told investors, “I don’t see anything that would stop us.”

The bank’s estimated Tier 1 capital ratio is actually 11.9 percent as of March 31, which is 21 basis points below what the company previously reported, according to today’s statement. The Tier 1 leverage ratio was 7.4 percent, or 12 basis points lower. A basis point is 0.01 percentage point.

Although the error did not materially impact Bank of America’s capital ratios, the bank has had more than it share of troubles lately and they last thing they needed was to make a public mea culpa to the Fed. In the latest quarter, BAC had a revenue decline of about 4% and in addition lost $514 million due to never ending legal costs.

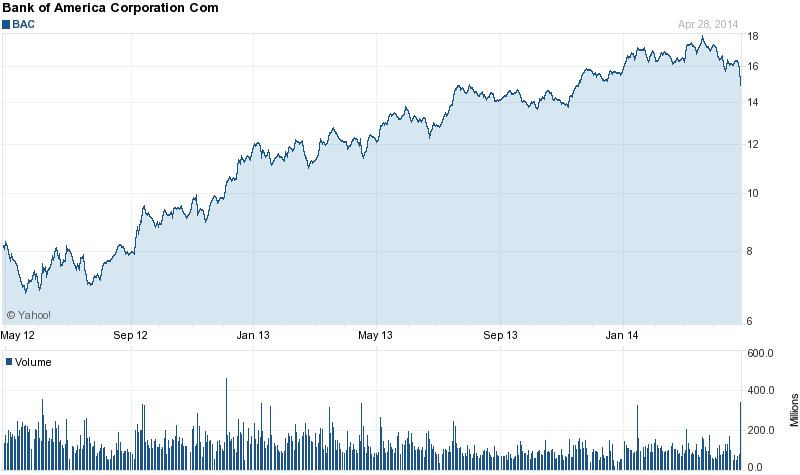

How damaging this latest setup will become remains to be seen. Over the past two years BAC has more than doubled in price and still has the blessing of Warren Buffett who holds a large position in the Bank.

Although this episode is embarrassing, BAC has prevailed over far larger problems during the past five years.

Speak Your Mind

You must be logged in to post a comment.