June 18, 2010 – Nevada saw its third banking failure of 2010 with the closing of Nevada Security Bank, Reno, Nevada. Failed Nevada Security was acquired by Umpqua Bank of Roseburg, Oregon, in a purchase and assumption transaction with the FDIC. Since the FDIC was able to find a buyer for Nevada Security Bank, all five branches of the failed bank will open as usual on Monday with no disruption to customers.

Nevada Security had been under regulatory supervision since a Cease and Desist order issued on June 25, 2009, in which the FDIC charged Nevada Security with following unsafe and unsound banking practices. Specific regulatory lapses cited by the FDIC in the Cease and Desist order included the following:

(a) operating with management and a board of directors whose policies and practices are detrimental to the Bank and jeopardize the safety and soundness of the Bank;

(b) operating with inadequate capital in relation to the kind and quality of assets held by the Bank;

(c) operating with a large volume of poor quality loans;

(d) operating in such a manner as to produce operating losses;

(e) operating with inadequate provisions for liquidity; and

(f) operating with excessive reliance on non-core funding and brokered deposits.

Shortly after the FDIC issued the Cease and Desist order to Nevada Security, founder and chairman Hal Giomi of The Bank Holdings (parent company of Nevada Security) stated that “Nevada Security Bank faces unprecedented challenges with the increasing level of non-performing loans, the steep declines in the underlying value of real estate collateral and the greater loan loss provisions required.”

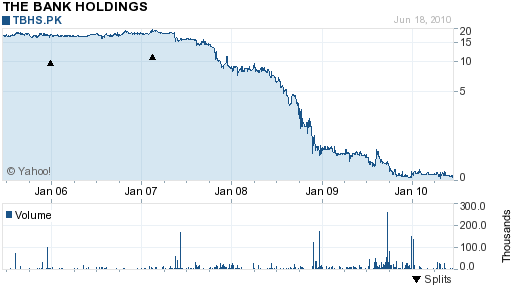

Nevada Security had lent heavily at the peak of the market on construction and development loans in Reno, Nevada, which subsequently experienced a major crash in real estate values. Nevada Security was also blindsided by the failure of Fannie Mae and Freddie Mac in which they had invested approximately $15 million in preferred stock. The preferred stock had counted as core capital but became essentially worthless after the government takeover of Fannie and Freddie. After being unable to raise additional capital, regulators had no choice but to close Nevada Security. The failure of Nevada Security wiped out stock owners in The Bank Holdings, which as recently as 2007 had traded at $20 per share. Shares of The Bank Holdings closed at 8 cents per share when last traded.

TBHS - COURTESY YAHOO FINANCE

At the time of closing, Nevada Security had $480.3 million in assets and $479.8 million in deposits. Umpqua Bank agreed to assume all the deposits and assets of failed Nevada Security. Umpqua and the FDIC entered into a loss-share agreement on $368.2 million of Nevada Security’s assets under which losses will be shared by Umpqua and the FDIC. According to the FDIC, the loss-share transaction maximizes returns by keeping assets in the private sector and minimizes disruptions to loan customers.

Umpqua Bank is a major bank in Oregon with $10.5 billion in assets and sees the acquisition of Nevada Security as an opportunity to expand in Nevada. Umpqua Bank had previously acquired two other failed banks this year and one in 2009. In a press release, Umpqua Bank stated that they expect “the acquisition to be immediately accretive to operating earnings per share”. Umpqua Chairman Ray Davis stated that “we are considered one of the strongest and most well capitalized community banks in the country”.

Umpqua Bank had received $214 million in government funds under the TARP program in November 2008 but repaid it in full in February 2010, with the Government earning $18 million on the transaction.

Nevada Security Bank is the nation’s 83rd banking failure this year and the 3rd in Nevada. The FDIC estimates the cost of closing Nevada Security at $80.9 million.

So what about AmericanWest? They’ve failed to meet every deadline and improvement the Fes have given them. How are they still operating? I was told they were so bad that the feds can’t find anyone willing to take them?

Mortgage Loan Modification is the only solution to save your home and stop foreclosure. Some 650,000 troubled borrowers have been put into trial loan modifications under the president’s foreclosure rescue plan, the Treasury Department said Tuesday. That number represents only 20% of eligible homeowners. Mortgage Home Modification Program is the solution to save your house and stop foreclosure process Use this free tool to see if you qualify for loan modification http://bit.ly/9iwXDC

Good point, AmericanWest Bank, Spokane, WA has a troubled asset ratio of 178 compared to a national median of 15.

Why hasn’t there been charges of criminal fraud against the CEO and members of the Board of Directors of the Nevada Security Bank? I’m just a depositor. NSB is just peanuts compared to the robbery of the peoples money by the big banks like B of A, Citibank and Wells Wargo. etc. They have ruined this country and we are beginning to find out how the banks paid the rating agencies to give them good ratings so they could debunk pension funds and caused the so much harm. President Obama is a weakling by not seizing the big banks as they continue to rape the United States.

The FDIC is just a bunch of babies for letting the NSB go as long as it did.

At age 74 I am just stunned and for my money we need a real live revolution and the hell with this nonsense called democracy. A complete breakdown of law and order would be better than we have now.