August 20, 2010 – Los Padres Bank, Solvang, California, was closed today and the FDIC appointed as receiver. To protect depositors, the FDIC sold failed Los Padres Bank to Pacific Western Bank, San Diego, California, which will assume all deposits and purchase essentially all assets of Los Padres.

All 14 branches of Los Padres will be opened as usual this weekend and all depositors of Los Padres will automatically become depositors of Pacific Western with no interruption in FDIC insurance coverage.

According to Pacific Western Bank’s website, they are “the 14th largest commercial bank headquartered in California out of 282 financial institutions with $5.1 billion in assets as of June 30, 2010. For nearly 30 years, Pacific Western Bank has served small and medium-sized businesses and their principals throughout California”.

Failed Los Padres had $870.4 million in assets and $770.7 million in deposits. Pacific Western will pay a premium of .45% to the FDIC on the deposits of Los Padres.

Pacific Western and the FDIC entered into a loss-share agreement covering $579.8 million of Los Padre’s assets to protect Pacific Western from losses on the asset pool purchased. The FDIC expects that losses on the asset pool will be minimized by keeping them in the private sector.

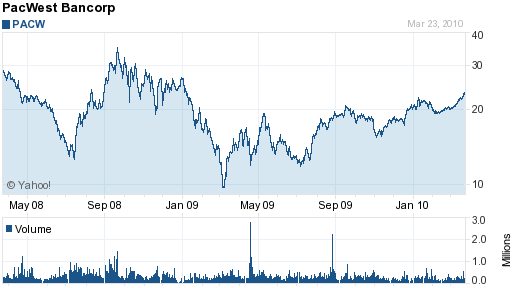

The parent company of Pacific Western is PacWest Bancorp, a publicly traded company whose stock has seen substantial appreciation since 2009 as the bank’s earnings recovered.

Los Padres Bank is the 117th banking failure this year. The cost to the FDIC insurance fund for closing Los Padres is $8.7 million. A total of four banks failed in California this week. The other bank failures in California this week were Sonoma Valley Bank of Sonoma, Butte Community Bank of Chico and Pacific State Bank of Stockton.

The FDIC does not provide an explanation regarding the loss on closing failed banks but the loss on Los Padres Bank, as a percentage of total assets is extremely small at 1%. (See Is The FDIC Understating The Cost Of Bank Failures?) During 2010, the average loss on closing a failed bank has amounted to 23% of a failed bank’s total assets.

Speak Your Mind

You must be logged in to post a comment.