August 20, 2010 – Independent National Bank, Ocala, Florida, was closed today by the Office of the Comptroller of the Currency which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with CenterState Bank of Florida, N.A., Winter Haven, Florida, to assume all deposits and assets of failed Independent National.

Normal business hours will continue for customers of Independent National and all depositors will automatically become depositors of CenterState Bank with no interruption in FDIC insurance coverage.

Independent National had $156.2 million in assets and $141.9 million in deposits.

The FDIC and CenterState Bank entered into a loss-share transaction on $119.7 million of Independent National’s assets which will limit potential losses to CenterState Bank on the acquired assets of the failed bank. The FDIC’s position on loss-share agreements is that by keeping assets in the private sector, ultimate losses on the failed bank’s assets are minimized.

Independent National was the 112th banking failure of the year and the 22nd failure in Florida, which leads the nation in banking failures. The estimated cost to the FDIC Deposit Insurance Fund on the failure of Independent National is estimated at $23.2 million.

CenterState Bank of Florida N.A. is owned by publicly traded parent company CenterState Banks Inc, which also purchased today another unaffiliated failed bank, Community National Bank at Bartow, Bartow, Florida. In July, CenterState Banks Inc acquired Olde Cypress Community Bank, Clewiston, Florida, that failed on July 16, 2010.

CenterState Banks Inc also announced in early August that it would acquire all four branches of Mercantile Bank, a division of Carolina First Bank, the banking subsidiary of The South Financial Group. Last month the Federal Reserve gave approval to Toronto-Dominion Bank for the acquisition of South Financial, with the stipulation that TD Bank divest the Mercantile Bank branches.

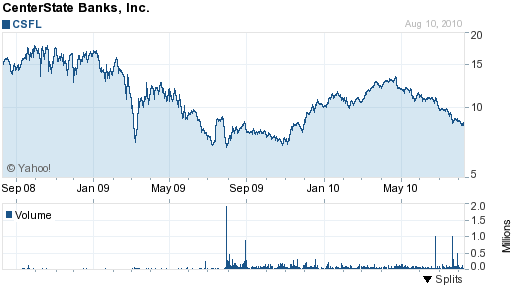

CenterState Banks Inc is a regional multi bank holding company doing business through 38 branch offices in Florida. For the second quarter of 2010, CenterState reported a profit turnaround with net income of $904,000 or 3 cents per share compared to a loss of $732,000 or 9 cents a share for the previous year. Although already well capitalized, CenterState Banks also announced a $30 million public stock offering. Despite the return to profitability, CenterState Banks has seen its stock price decline since May in a general sell off of banking stocks.

CenterState Banks, Inc (CSFL)

Speak Your Mind

You must be logged in to post a comment.