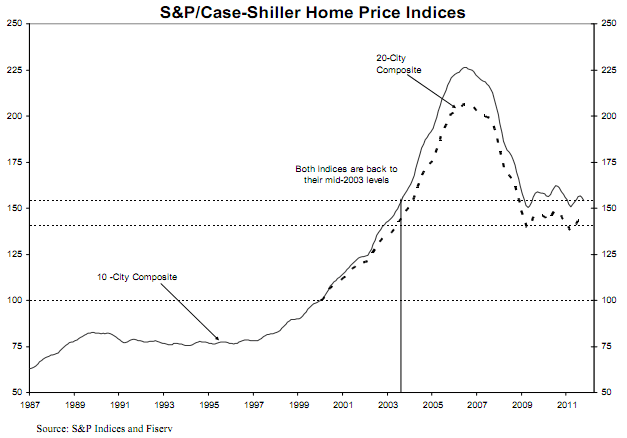

Home prices continue to plunge in value. According to the latest statistics from S&P/Case-Shiller, prices declined by over 1% in October. The crash in housing prices has now brought prices back to levels last seen in 2003.

Each local housing market is unique with some states such as Florida and Nevada experiencing much greater price declines than average. The end result is that prices have become shockingly low in many parts of the country. Here’s a sampling of foreclosed HUD homes for sale that many folks could easily purchase with their credit cards.

Investors apparently see great bargains in many distressed properties. In the past year, investors purchases have accounted for a huge 38% of home purchases.

The HUD properties are basically offered “as is” and many of them will need repairs and upgrading. HUD gives buyers who plan to live in the house first rights at making a purchase offer, after which investors offers are taken.

Besides getting a bargain price on many of the homes offered for sale by HUD, there are special price discounts given to certain qualified buyers. While collapsing home prices have caused a great deal of financial distress to both banks and homeowners alike, buyers of distressed properties may be buying at the bottom of market.

Speak Your Mind

You must be logged in to post a comment.