September 10, 2010 – Horizon Bank, Bradenton, Florida, was closed by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Bank of the Ozarks, Little Rock, Arkansas, to assume all of the deposits and essentially all of the assets of Horizon Bank.

All four branches of Horizon Bank will reopen on Monday as of branches of the Bank of the Ozarks and all Horizon Bank depositors will automatically become depositors of Bank of the Ozarks.

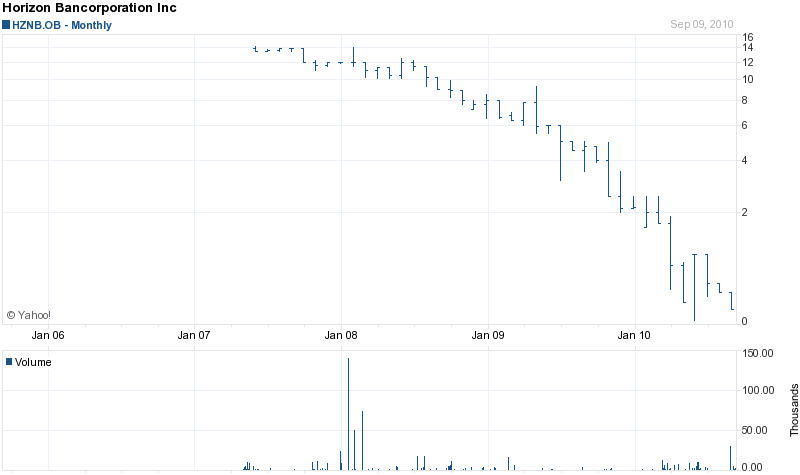

Horizon Bank, a mid sized commercial bank owned by parent company Horizon Bancorporation, Inc. was chartered in 1998. Horizon Bancorporation conducted an initial public offering in 1999 which raised approximately $5 million to capitalize Horizon Bank.

In early 2009 Horizon Bank suffered serious deterioration in its financial condition as dramatic declines in the value of Florida real estate resulted in a wave of loan defaults. A May 2009 regulatory exam resulted in Horizon Bank charging off a significant amount of commercial and real estate loans which caused the bank’s total risk-based capital to fall below required minimum levels.

In August 2009 the Atlanta Federal Reserve Bank declared Horizon Bank to be undercapitalized and required the bank to submit a capital restoration plan. Subsequent attempts by Horizon Bank to raise additional capital were deemed inadequate by regulators.

On March 4, 2010, Horizon was issued a Prompt Corrective Action by the Board of the Federal Reserve to immediately take measures to make the Bank adequately capitalized. Horizon Bancorporation’s attempt to raise additional capital in a secondary stock offering were unsuccessful and regulators were forced to close the bank.

Shareholders in Horizon Bancorporation are facing a complete loss as the stock last traded today at 13 cents. Horizon’s stock had traded as high as $14 per share in 2007.

Horizon Bank had $187.8 in total assets and $164.6 in total deposits at June 30, 2010. The FDIC did not receive a premium on the sale of Horizon’s deposits to Bank of the Ozarks. The FDIC and Bank of the Ozarks entered into a loss-share transaction on $150.4 million of Horizon Bank’s assets under which the FDIC and Bank of the Ozarks will share in the losses on the failed bank’s assets.

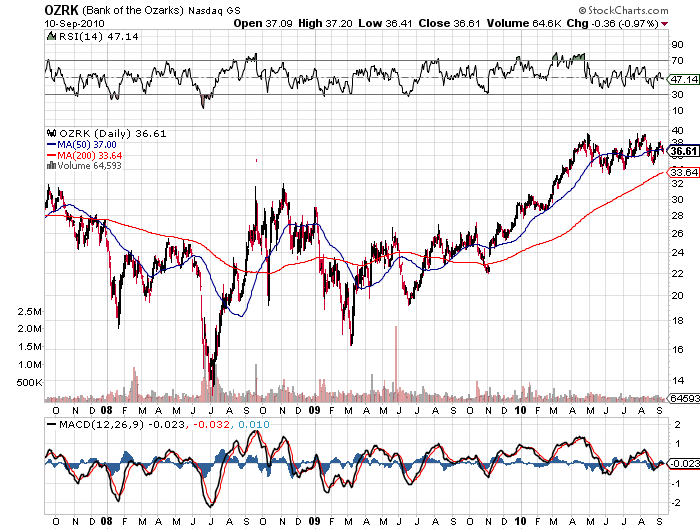

Bank of the Ozarks had received $75 million under the Troubled Asset Relief Program but fully paid back the Treasury in November 2009. Bank of the Ozarks has over $3 billion in assets and is based in Little Rock, Arkansas. The company’s stock price and earnings have recovered significantly since the lows of 2008.

OZRK - COURTESY STOCKCHARTS.COM

The estimated loss to the FDIC Deposit Insurance Fund for the failure of Horizon Bank is $58.9 million or 31% of Horizon’s total assets. Horizon is the 119th banking failure of 2010 and the twenty-third in Florida. Florida now leads the nation in banking failures (see Banking Failures by State).

I was a stock holder at Horizon Bank FL. Does the bank failure mean I lose all of my investment? Or do my shares get carried over into Bank of the Ozarks?

According to the FDIC:

All shares of Horizon Bank were owned by its holding company, Horizon Bancorporation, Inc., Bradenton, FL. The holding company was not included in the closing of the bank or the resulting receivership. If you are a shareholder of Horizon Bancorporation, Inc., please do not contact or file a claim with the Receiver. You may contact Horizon Bancorporation, Inc. directly for information as follows:

Horizon Bancorporation, Inc.

900 53rd Avenue East

Bradenton, FL 34203

In accordance with Federal law, allowed claims will be paid, after administrative expenses, in the following order of priority:

1.Depositors

2.General Unsecured Creditors

3.Subordinated Debt

4.Stockholders