Three years after the height of the financial crisis, the issue of impaired assets on bank balance sheets remains a major risk to the health of the banking system.

Regulators have allowed banks to avoid taking losses on impaired assets by not requiring mark to market accounting. The extent of overvaluation on bank loans can be seen every time a bank fails and the FDIC has to routinely take losses of 20% on the failed bank’s assets before being able to sell the failed bank. In addition, buyers of failed banks routinely receive protection from future declines in asset values through the use of loss-share agreements with the FDIC.

This “extend and pretend” strategy of not recognizing loan losses might have work if property values recovered. Instead, a rapidly weakening economy, high unemployment and declining incomes have further weakened property values. Banks are reluctant to lend because they know that their capital is effectively impaired due to inflated loan values on their balance sheets. The looming recession will compound losses at banks as collateral values continue to decline and defaults increase.

Consider the forecast of the Economic Cycle Research Institute (ECRI) that correctly called three recessions:

Early last week, ECRI notified clients that the U.S. economy is indeed tipping into a new recession. And there’s nothing that policy makers can do to head it off.

A new recession isn’t simply a statistical event. It’s a vicious cycle that, once started, must run its course. Under certain circumstances, a drop in sales, for instance, lowers production, which results in declining employment and income, which in turn weakens sales further, all the while spreading like wildfire from industry to industry, region to region, and indicator to indicator. That’s what a recession is all about.

It’s important to understand that recession doesn’t mean a bad economy – we’ve had that for years now. It means an economy that keeps worsening, because it’s locked into a vicious cycle. It means that the jobless rate, already above 9%, will go much higher, and the federal budget deficit, already above a trillion dollars, will soar.

Here’s what ECRI’s recession call really says: if you think this is a bad economy, you haven’t seen anything yet. And that has profound implications for both Main Street and Wall Street.

If the ECRI is only half correct, we are heading into a deep economic slide with a banking system that is still insolvent from the continuing banking crisis that began in 2008. Despite wishful thinking by regulators, we also still have “too big to fail” banks with the four largest banks holding $3.6 trillion in assets and the next 46 largest banks holding $2.7 trillion in assets. The 50 biggest banks hold 46% of total banking assets.

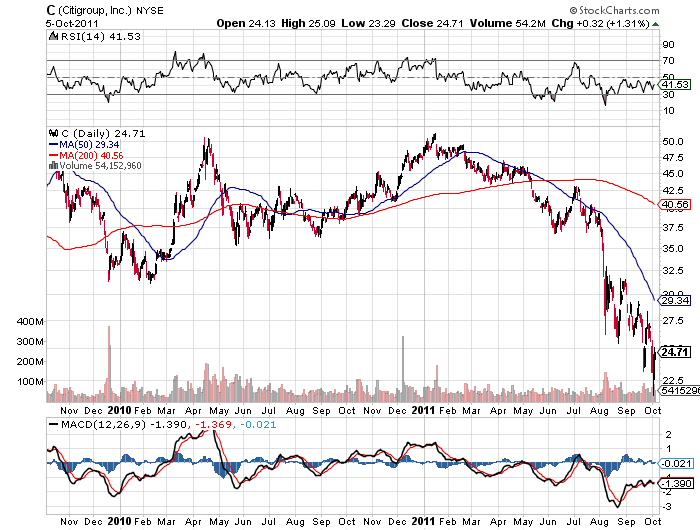

Citigroup is one of the “too big to fail banks” that still has hundreds of billions of dollars of unresolved problem loans. Troubled assets totaling $662 billion were segregated and transferred to a unit called Citi Holdings in 2009. Almost three years later Citi Holdings still has $308 billion in low quality assets that it is attempting to liquidate. As a point of reference, all of the 865 banks listed as “Problem Banks” by the FDIC have total assets of $372 billion.

Citi’s attempt to deal with its problem loan portfolio are detailed in Citi Faces Struggle.

The remaining unwanted pile, known as Citi Holdings, has $308 billion in assets, less than half its size when it was created in 2009.

Now comes the hard part: getting rid of the rest.

Citi Holdings offers a glimpse into the problems that banks still are grappling with three years after the financial crisis erupted. The assets in Citi Holdings have racked up $59 billion in losses since 2007. And as profits sag across the U.S. banking industry along with hopes for a strong economic rebound, Citi Holdings is likely to keep dragging the overall company lower for years to come.

Nearly 40% of Citi Holdings consists of home mortgages, for which there are few buyers except in small amounts. Slightly more than one-third of those loans are home-equity credit lines. Their position behind a first mortgage can render them worthless when borrowers enter foreclosure.

Mike Corbat, chief executive of Citi Holdings, says anyone who expects those loans to disappear entirely in the near term should think again. “That is just not a realistic expectation,” Mr. Corbat said in an interview. Citigroup executives say the bank is adequately reserved against future losses.

The problem for Citigroup and the entire banking industry is that no one believes delinquent and troubled loan portfolios are properly reserved for, and the proof is seen in crashing bank stock prices.

Most of the world’s banks are insolvent based on mark to mark accounting and a recession would cause a larger banking crisis than the warm up experienced in 2008. Due to already massive levels of debt, many sovereign nations may find themselves unable to bail out failing banks which would precipitate world wide banks runs and panics. Does anyone really think that the gridlocked political system can come up with solutions to prevent this nightmare outcome?

Speak Your Mind

You must be logged in to post a comment.