The First National Bank of Olathe, established in 1887, was closed today by the Office of the Comptroller of the Currency. The FDIC, appointed as receiver, sold the failed bank to Enterprise Bank & Trust, Clayton, Missouri.

Enterprise Bank & Trust will assume all deposits of failed First National Bank of Olathe. All six branches of failed First National Bank of Olathe will reopen on Saturday as branches of Enterprise Bank & Trust. All depositors of the failed bank will have full access to their money over the weekend through check writing, debit cards or ATMs.

First National Bank of Olathe, during its 124 year history, established itself as one of the largest independent community banks in the area that it served. Rapid loan growth during the boom years quickly resulted in large losses when real estate markets headed south.

In February, 2010, First National Bank signed a consent agreement with the Comptroller of the Currency, in which the Bank agreed to raise additional capital to offset rapidly increasing losses on its loan portfolio. First National Bank’s troubled asset ratio rose rapidly from early 2009 and reached 505% in March of this year. A bank with a troubled asset ratio of over 100% has a very high probability of failing and First National Bank was no exception to this rule.

At June 30, 2011, First National Bank of Olathe had total assets of $538.1 million and total deposits of $524.3 million. Enterprise Bank & Trust will pay the FDIC a premium of 1.5% on the deposits assumed and, in addition, purchase all of the failed bank’s assets.

Enterprise Bank & Trust and the FDIC entered into a loss-share transaction covering $419.6 million of the assets acquired from First National Bank. The loss-share agreement will limit the losses of Enterprise Bank & Trust on the asset pool acquired. According to the FDIC, losses on failed banking assets are minimized by keeping the assets in the private sector.

First National Bank is the third failed bank acquisition by Enterprise Bank. In December 2009, Enterprise Bank & Trust acquired Valley Capital Bank of Mesa, Arizona, and in January 2011, acquired Legacy Bank of Scottsdale, Arizona. The three failed banks acquired by Enterprise Bank & Trust had total assets of $728 million. In addition, Enterprise Bank also acquired a pool of failed bank assets from the FDIC in July 2010.

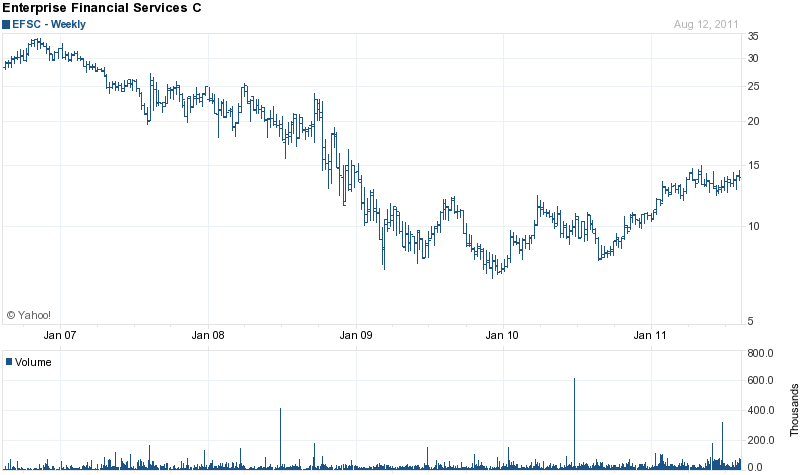

Enterprise Bank & Trust is owned by holding company Enterprise Financial Services (EFSC) which has $2.9 billion in assets. All of the acquisitions from the FDIC have been very profitable for EFSC. After the Legacy Bank acquisition in January, EFSC issued a press release that disclosed the impact on earnings from the failed bank and asset purchases from the FDIC.

On July 9, 2010, the Company acquired approximately $260 million in Arizona-originated assets from the FDIC in connection with the failure of Home National Bank (“HNB”) of Blackwell, Oklahoma. The assets were purchased at a 12.5% discount and are covered by a loss share agreement with the FDIC. The asset purchase was the Company’s second FDIC-assisted transaction in Arizona.

Pre-tax, pre-provision income from continuing operations was $16.4 million in the third quarter of 2010, nearly double the $8.6 million reported for the prior year period and 70% higher than the second quarter of 2010. The HNB asset purchase contributed approximately $5.8 million to third quarter pre-tax, pre-provision income.

Peter Benoist, President and Chief Executive Officer, commented, “For the third consecutive quarter, the Company has grown pre-tax, pre-provision operating earnings. Our Arizona asset purchase from the FDIC contributed substantially to our third quarter results. While these results are indeed encouraging and the early favorable results from our Arizona acquisitions bode well for future earnings, we do not yet see significant signs of recovery, particularly in the housing and commercial real estate markets,” continued Benoist. ”As a result, we expect nonperforming asset levels to remain elevated.”

According to a EFSC press release, today’s acquisition of First National Bank of Olathe “is expected to be immediately accretive to net income, diluted earnings per share and book value per common share.”

Today’s sale of failed Bank of Olathe continues an FDIC practice of selling failed banks to banks that still owe the US Treasury money under the TARP program. (see Banks With $1.2 Billion in Unpaid TARP Loans Buy 18 Failed Banks from FDIC). Enterprise Financial Services still owes $35 million to the US Treasury that it borrowed in December 2008 under the TARP’s Capital Purchase Program.

Enterprise Financial Services is well capitalized, profitable, pays a dividend to its shareholders and raised $35 million in a common stock offering in May 2011. The last 10Q filed by Enterprise Financial makes no mention of when the $35 million TARP loan will be repaid. In the meantime, the US Treasury is collecting 5% dividend payments from EFSC.

The failure of Bank of Olathe will cost the FDIC Deposit Insurance Fund $116.6 million. First National Bank of Olathe is the nation’s 64th banking failure of 2011 and the first in Kansas.

Speak Your Mind

You must be logged in to post a comment.