Stress tests of the largest banks in the country against a financial hurricane of “extremely adverse” economic conditions shows that almost all of the largest banks in the country would be able to maintain adequate capital levels. The Federal Reserve said that 18 of the 19 banks stress tested would survive even if stock prices collapsed 50%, the unemployment rate soared to 13% and housing prices declined another 21% The Fed estimated that even under these extremely adverse conditions the banks could absorb $534 billion in losses and still have more than enough capital to survive.

A short four years after the entire banking industry was nearing the abyss of insolvency, the Federal Reserve is now telling us that all the major banks could survive an economic depression. With trillions of dollars of Federal Reserve and government bailouts and ultra low funding costs, the banking industry is now apparently in terrific shape and banks are once again paying their executives huge bonuses. Let’s take a look at how bank stock investors, borrowers and depositors made out over this same time period.

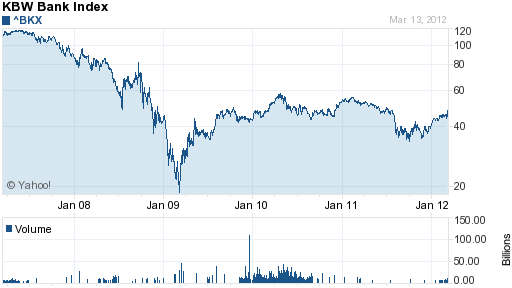

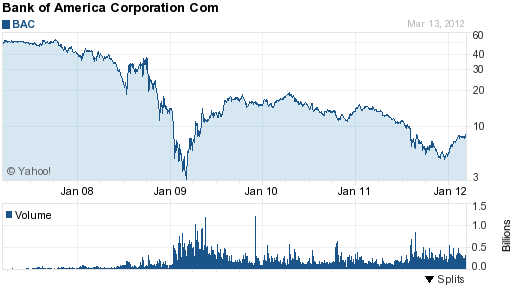

Last year, bank stock investors were panic selling bank stocks, worried that the sovereign credit crisis in Europe would sink major U.S. banks. Since the beginning of the year, bank stocks have been in a massive rally and today’s news from the Fed propelled the S&P Banking Index up almost 5%. Long term investors in bank stocks, however, are still sitting on massive losses. The KBW Bank Index is still 62% off it price level of 2007 and shareholders in bank stocks such as Bank of America are still down over 80% from 2007.

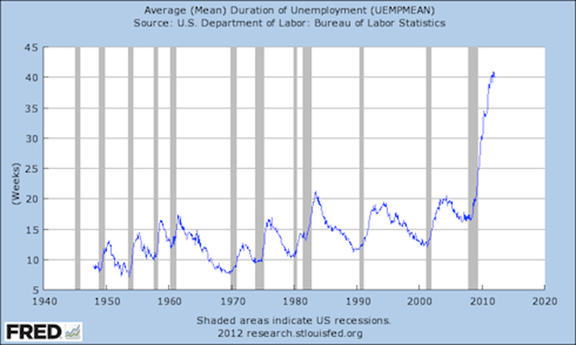

Borrowers are still overburdened with massive amounts of debt and high monthly payments despite the Fed’s efforts to force interest rates lower. Meanwhile, unemployment rates remain at depression style levels and wages have not increased for the average American worker over the past decade.

Bank depositors, including many retired people, who were frugal and managed to save some of their paycheck, are now subject to the cruel realities of financial repression by the Federal Reserve. Terrified of losing their life savings, many people have kept their savings in the bank where it is “safe” due to FDIC deposit insurance.

Savings in the bank may be “safe” but the purchasing power of bank savings is being systematically destroyed by a combination of zero interest rates and rising inflation. The Federal Reserve has publicly stated that interest rates will remain near zero indefinitely and that their target rate for inflation is 2%. Savers who take the time to do the math realize that their interest income has disappeared even as the cost of living has increased. Over the past 20 years, according to government statistics, inflation has averaged 2.49%. In today’s dollars, you need $1,636 to buy what cost only $1,000 in 1992.

Exactly why would the Federal Reserve engage in the systematic destruction of the purchasing power of the dollar? A recent paper by Carmen Reinhart explains the Fed’s actions and why Financial Repression Has Come Back To Stay.

As they have before in the aftermath of financial crises or wars, governments and central banks are increasingly resorting to a form of “taxation” that helps liquidate the huge overhang of public and private debt and eases the burden of servicing that debt.

Such policies, known as financial repression, usually involve a strong connection between the government, the central bank and the financial sector. In the U.S., as in Europe, at present, this means consistent negative real interest rates (yielding less than the rate of inflation) that are equivalent to a tax on bondholders and, more generally, savers.

Throughout history, debt-to-GDP ratios have been reduced in five ways: economic growth, substantive fiscal adjustment or austerity plans, explicit default or restructuring of private and/or public debt, a surprise burst in inflation, and a steady dose of financial repression that is accompanied by an equally steady dose of inflation. It is critical to note that the last two options — inflation and financial repression — are only viable for domestic-currency debts (the euro area is a special hybrid case).

Complicating the situation is the fact that the debt overhang isn’t limited to the public sector, as it was immediately after World War II. There is now a high degree of leverage in the private sector, especially in the financial industry and households. In addition, the recent buildup in external leverage was greater than in past crises. This debt overhang and the financial fragility it creates are a common feature of most advanced economies, along with stubbornly high unemployment. Concerns that higher real interest rates and deflation will worsen an already precarious situation will probably impose added constraints on monetary policy.

One of the main goals of financial repression is to keep nominal interest rates lower than would otherwise prevail. This effect, other things being equal, reduces governments’ interest expenses for a given stock of debt and contributes to deficit reduction. However, when financial repression produces negative real interest rates and reduces or liquidates existing debts, it is a transfer from creditors (savers) to borrowers and, in some cases, governments.

Faced with a private and public domestic debt overhang of historic proportions, policy makers will be preoccupied with debt reduction, debt management, and, in general, efforts to keep debt-servicing costs manageable.

In this setting, financial repression in its many guises (with its dual aims of keeping interest rates low and creating or maintaining captive domestic audiences) will probably find renewed favor and will likely be with us for a long time.

(Carmen M. Reinhart, a senior fellow at the Peterson Institute for International Economics in Washington, is the author, with Kenneth S. Rogoff, of “This Time is Different: Eight Centuries of Financial Folly.”

Bank stock investors may eventually see the value of their investment come back as banks reap the gains of ultra low funding costs and borrowers will continue to enjoy low interest rates. Bank depositors, however, face a bleak future of zero interest income and continual depreciation of the purchasing power of their savings.

Speak Your Mind

You must be logged in to post a comment.