Allegiance Bank of North America, Bala Cynwyd, Pennsylvania, was closed today by the Secretary of the Pennsylvania Department of Banking, which appointed the FDIC as receiver. The FDIC entered into a purchase and assumption agreement with VIST Bank, Wyomissing, PA, to assume all deposits and purchase all assets of failed Allegiance.

Allegiance was a state-chartered commercial bank formed in 1999. Allegiance had five branches which will reopen on Monday as branches of VIST Bank. All Allegiance depositors will automatically become depositors of VIST with no interruption in FDIC deposit insurance coverage. Customer funds will be available over the weekend by check, ATM or credit cards.

At September 30, 2010, Allegiance Bank had $106.6 million in total assets and $92.0 in total deposits. VIST will pay the FDIC a premium of 0.50% on the assumed deposits. VIST Bank also agreed to purchase essentially all of the assets of the failed bank.

VIST Bank and the FDIC entered into a loss-share transaction covering $86.2 million (80%) of the purchased assets. The loss-share transaction limits the losses to VIST Bank on the asset pool acquired from Allegiance. The FDIC makes extensive use of loss-share transactions to facilitate the sale of failed banks to potential purchasers. The FDIC’s position is that loss-share transactions maximize returns on the failed bank assets by keeping them in the private banking sector.

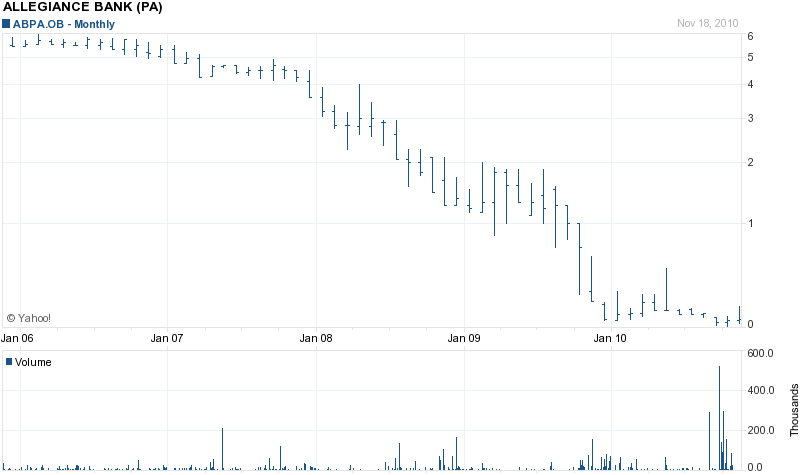

Allegiance had been struggling with nonperforming loans and was issued a Consent Order by the FDIC in November 2009 ordering Allegiance to raise additional capital. The Bank’s condition continued to deteriorate and for the quarter ending September 30, 2010, nonperforming loans increased by almost 10% and losses doubled from the previous year to $1.9 million. An effort to raise additional capital in a private share offering was unsuccessful with the Bank being unable to sell any shares. Allegiance Bank, whose shares had sold for $6 a share in 2006, ending trading today at $.06. Shareholders are highly unlikely to ever see a recover of their investment.

The estimated loss to the FDIC Deposit Insurance Fund for the failure of Allegiance Bank is estimated at $14.2 million. Allegiance is the 148th banking failure of the year and the first in Pennsylvania.

VIST Bank Receives TARP Money, Does Not Pay It Back and Buys A Failed Bank

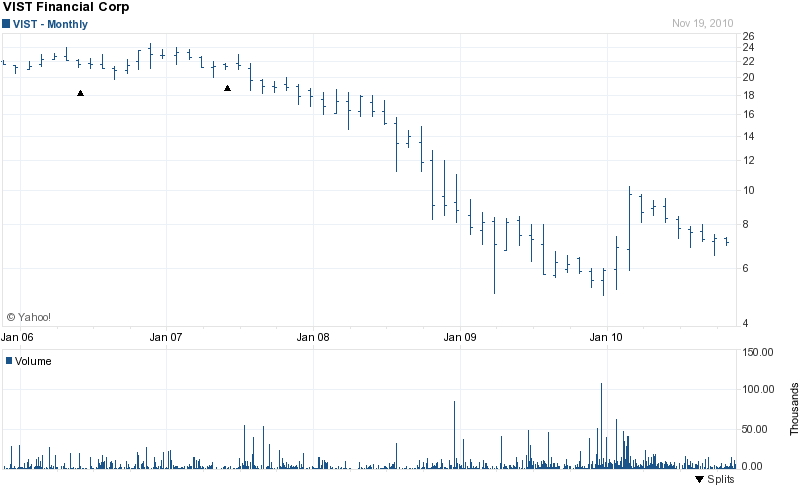

There has been much discussion in the press lately about the increased competition for failed banks by buyers, but this may be more hype than reality. In recent weeks, we have seen the majority of failed banks being purchased by institutions that still owe TARP money to the US Treasury. Consider that VIST Financial Corp (the holding company for VIST Bank) was the recipient of TARP money, receiving $25 million dollars in November 2008 from the US Treasury in exchange for preferred stock and warrants under the Capital Purchase Program. VIST Financial has still not paid back the US Treasury, although they have been making the required dividend payments on time and, to date, have paid the US Treasury $2 million. It would seem logical that if the FDIC had a large number of suitors for failed banks, they would select the financially strongest buyer and exclude institutions that have not paid back government TARP money.

VIST Financial is still paying stockholder dividends and according to Yahoo Finance, will disburse the next shareholder dividend on November 14, 2010. See related story Fed Puts Bank Dividend Payment On Hold. VIST Financial common stock currently has a dividend yield of 2.7%.

Thank you a lot for sharing this with all of us you actually recognize what you are speaking about! Bookmarked. Please also consult with my website =). We could have a hyperlink change arrangement between us