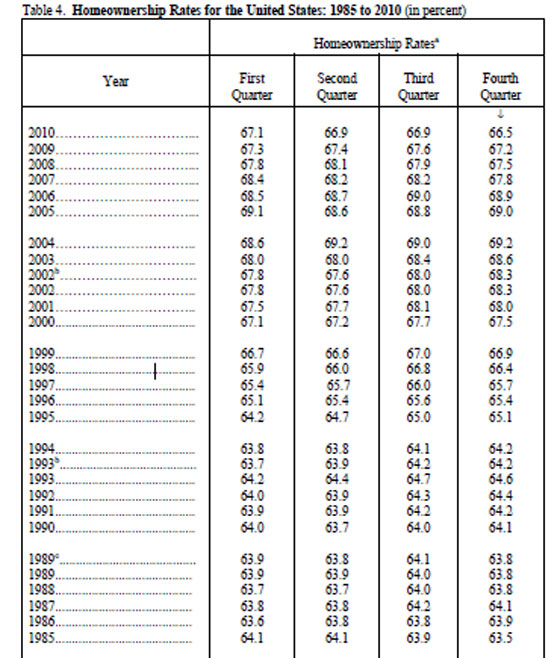

The Census Bureau reports that the level of homeownership has declined to 66.5% for the last quarter of 2010. The number of Americans owning a home is now at the lowest level since 1998 when the rate of ownership was slightly lower at 66.4%.

The lower rate of homeownership is not a disaster, as portrayed by many press reports. The data from the Census Bureau going back to 1985 shows a normalized level of homeownership at approximately 64%. The current homeownership rate is still above long term trend despite high foreclosure rates.

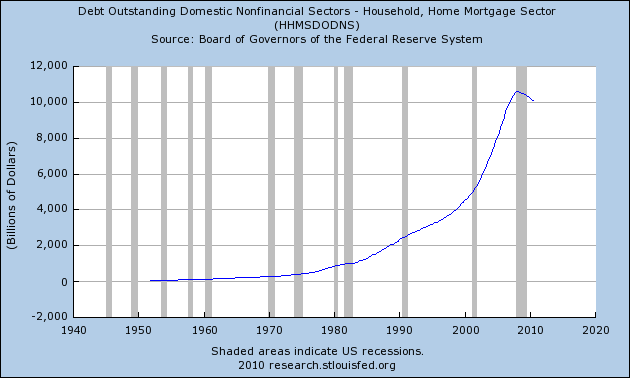

Homeownership rates did not start to increase above historical norms until the mid 1990’s when mortgage lending was starting a parabolic increase that ended abruptly in 2007. Banks dramatically expanded mortgage lending with products that required little or no documentation of income. Super aggressive mortgage programs also allowed home purchases with zero downpayments.

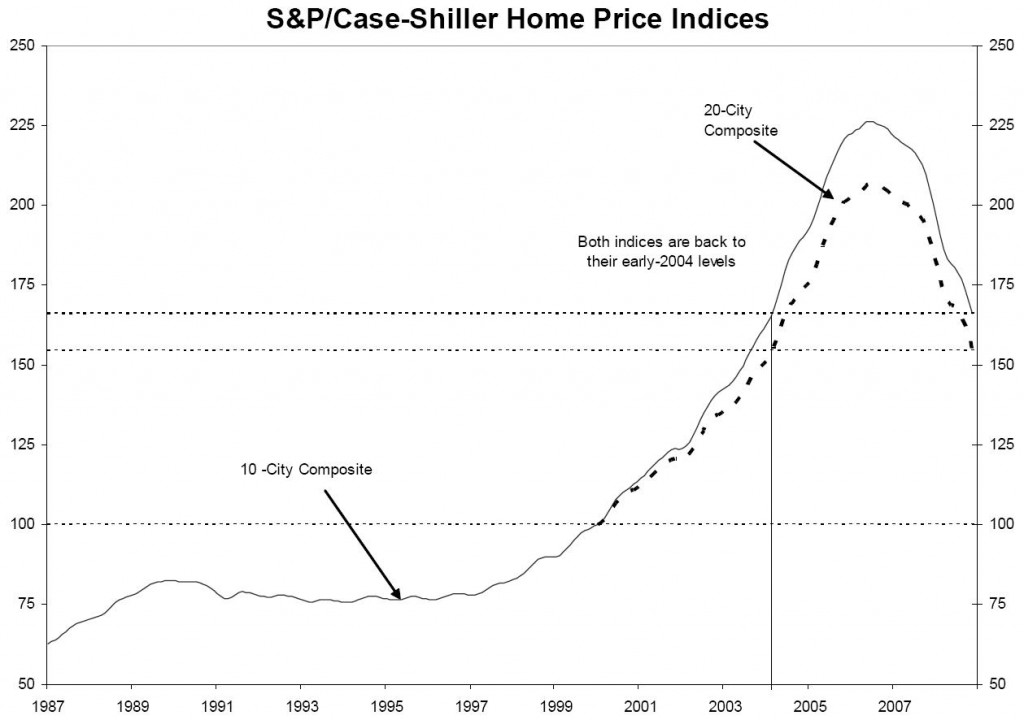

Skyrocketing home prices and loose lending encouraged many people to buy homes on terms that essentially represented a zero cost, long term option on future home price appreciation. It was an irresistible deal all around – fast money for buyers as housing prices rose and fat fees for banks that passed off default risk via mortgage securitizations.

Pro homeownership policies by the government, combined with bankers eager to approve every mortgage application, brought the level of homeownership to an all time high of approximately 69% during the boom. Borrowers who never would have qualified for a home mortgage under prudent underwriting guidelines helped fuel the perpetual wealth machine now known as the housing bubble.

The decline in homeownership rates is not a disaster. The greater concern should be focused on the continuing decline in property values and the remaining mountain of mortgage debt.

Mortgage lending accelerated at an epic pace until total mortgage debt for 1 to 4 family residences reached a peak of $11.2 trillion in 2007. From the early 1980’s to the peak of the boom in 2007, mortgage debt increased by a staggering 1120% or $10.2 trillion.

Aftermath of the Bubble

In the aftermath of the bubble, defaulting mortgages brought the banking industry to the brink of insolvency. Intervention by governments world wide to rescue the financial system with trillions of dollars in debt has raised the risk of numerous sovereign defaults. Worst of all, the mortgage debt remains while housing values have spiraled downwards. Imperiled collateral values raise the risk of further defaults which may require further intervention by governments already at the limits of borrowing capacity.

Reversion To The Mean?

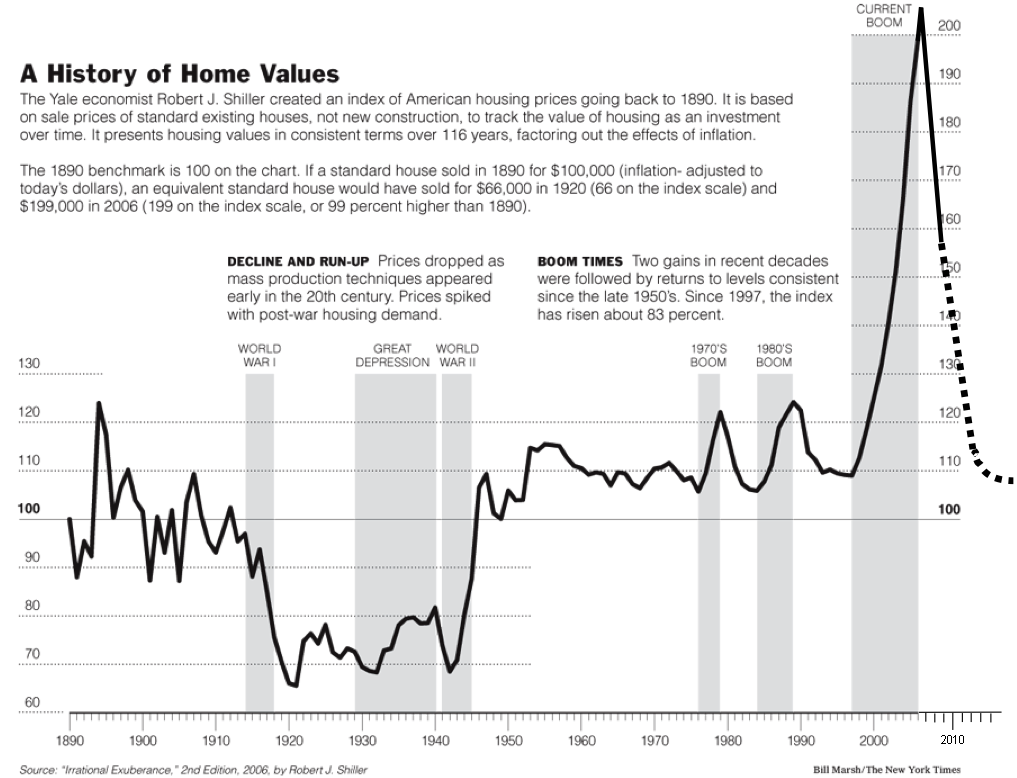

For those who believe in the statistical phenomenon of reversion to the mean, our biggest nightmare may lie ahead of us if housing prices revert to pre-bubble levels as experienced in Japan.

Speak Your Mind

You must be logged in to post a comment.