One of the country’s oldest banks, Citizens First National Bank, Princeton, IL, was closed today by the Comptroller of the Currency. The FDIC, acting as receiver, sold the failed bank to Heartland Bank and Trust Company, Bloomington, IL.

One of the country’s oldest banks, Citizens First National Bank, Princeton, IL, was closed today by the Comptroller of the Currency. The FDIC, acting as receiver, sold the failed bank to Heartland Bank and Trust Company, Bloomington, IL.

Citizens First National, a large bank with 21 branches and almost $1 billion in assets, becomes the second largest bank failure of the year. The largest banking failure of the year occurred in January when regulators closed Tennessee Commerce Bank which had total assets of $1.2 billion.

Citizens First National Bank’s roots reach back to 1865. According to the Bank’s website, Citizens First National Bank was the result of the merger of three local banks after the stock market crash of 1929.

As of banking crisis unfolded during 2008, many of Citizens First loans defaulted. By June 2012, the troubled asset ratio of the Bank has climbed to 200%. Historically, a bank with a troubled asset ratio in excess of 100% nearly always winds up failing. Citizens First National Bank has been under regulatory scrutiny since September 2011 when the Bank signed a Consent Order with the Comptroller of the Currency.

The Consent Order required Citizens to implement a Strategic Plan to improve financial and operational controls. In addition, under the terms of the Consent Order, Citizens was ordered to improve certain capital ratios within 90 days. The Bank was unable to raise additional capital and, as defaulted loan levels continued to increase, regulators had no choice but to close the insolvent bank.

All 21 branches of Citizens First National Bank will reopen on Saturday as branches of Heartland Bank and Trust. All depositors of Citizens will automatically become depositors of Heartland with uninterrupted FDIC insurance coverage up to the applicable limits. Over the weekend, depositors of Citizen can access their money through the use of checking accounts, ATMs and debit cards.

At September 30, 2012, Citizens had total assets of $924.0 million and total deposits of $869.4 million. Heartland Bank agreed to purchase all of the failed bank’s assets in addition to assuming all of the failed bank’s deposits.

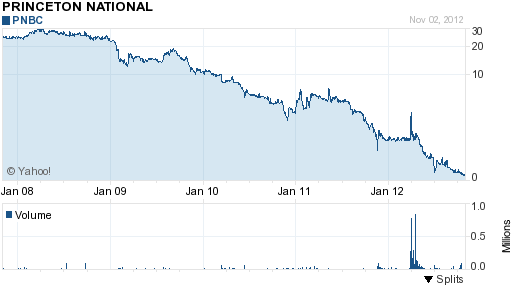

Citizens First National Bank was owned by its holding company, Princeton National Bancorp, Inc., whose shares have been in a nonstop decline since 2008. Shares of Princeton National Bancorp, once valued at over $120 million are now worthless.

Heartland Bank and Trust has now acquired a total of 4 failed banks since March 2010. Heartland Bank and Trust is an 80 year old, locally owned bank that is regarded as one of the soundest banks in Illinois. Heartland, which was founded in 1971, has over $1.9 billion in total assets.

The cost to the FDIC Deposit Insurance Fund for the failure of Citizens First National Bank is $45.2 million. Citizens First becomes the nation’s 49th banking failure of the year and the 8th in Illinois. Since the start of the financial crisis in 2008, a staggering total of 463 banks have failed and over 10% of all FDIC insured banks still remain on the Problem Bank List.

Follow loss share on twitter watch this video of the House Finanicial oversight comitee

http://www.youtube.com/watch?v=Wv2gsL6Jy8c