California saw its third banking failure this year as regulators closed a small bank that had been overwhelmed by loan losses. Charter Oak Bank of Napa, California, was closed today by the California Department of Financial Institutions, which appointed the FDIC as receiver. The FDIC sold the failed bank to Bank of Marin, Novato, California, which will assume all deposits of failed Charter Oak.

Charter Oak Bank had two branches with $120.8 million in assets and $105.3 million in deposits. The Bank had been seeking a merger partner and on January 20, 2011, announced that company shareholders had approved a merger agreement with Bay Commercial Bank. The announced merger was never consummated.

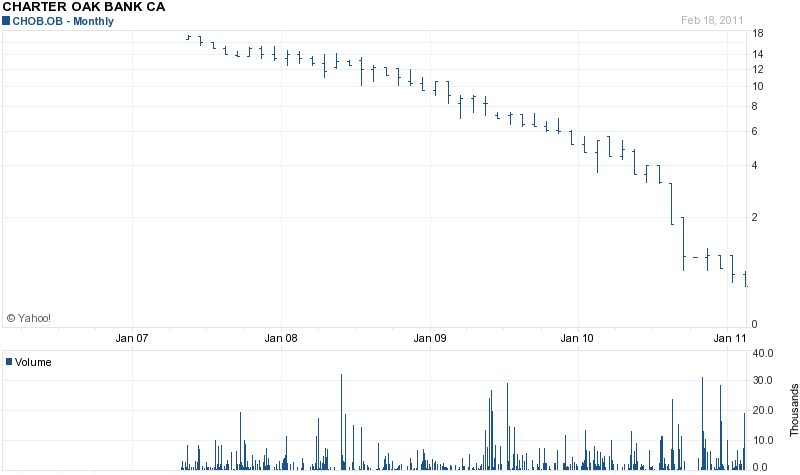

Charter Oak Bank’s stock has been in a steady downtrend since 2008 as the Bank’s financial condition deteriorated.

Bank of Marin purchased only a portion of the failed bank’s assets, leaving the FDIC stuck with $28.5 million of poor quality assets for later disposition. (See FDIC’s Mountain of Failed Bank Assets Grow).

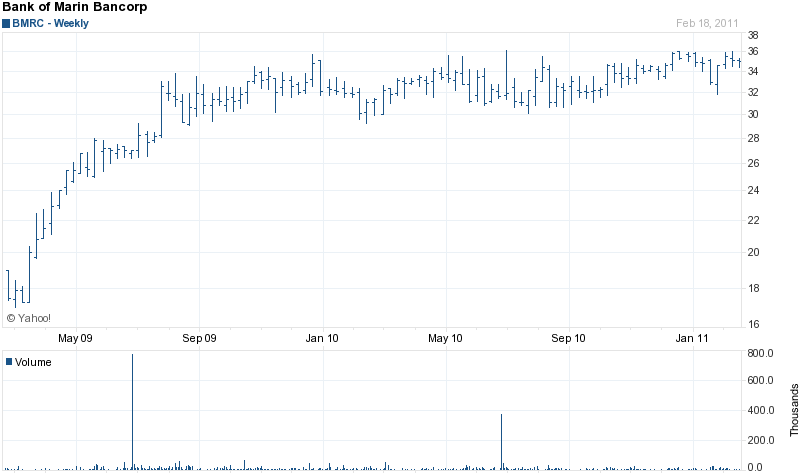

The Bank of Marin was opened in 1990 and has since expanded to 13 branch offices that focus on small to medium sized businesses, professionals and not-for-profit organizations. Bank of Marin is well capitalized, has over $1.2 billion in assets, pays a cash dividend and has seen the price of its stock double from the lows of 2009.

The estimated loss to the FDIC DIF on the closing of Charter Oak Bank is $21.8 million. Charter Oak is the nation’s 21st banking failure and the second in California.

Speak Your Mind

You must be logged in to post a comment.