Charter National Bank and Trust, Hoffman Estates, Illinois, was closed today by the Office of the Comptroller of the Currency, becoming the eight banking failure of 2012.

Charter National, a small 32 year old community bank, became overwhelmed by bad loans after real estate prices began to collapse in 2008. The latest reports on Charter National show a troubled asset ratio of 616% indicating that the Bank was under severe stress caused by loan defaults. Almost without exception, a bank with a troubled asset ratio of over 100% winds up failing.

Charter National Bank had been under regulatory scrutiny for almost two years. On April 29, 2010, Charter National signed a consent order with the OCC that required the Bank to raise additional capital which proved impossible to do.

The FDIC, appointed as receiver, sold the failed Bank to Barrington Bank & Trust Company, Illinois, which is a wholly owned subsidiary of Wintrust Financial Corp.

Charter National’s two branches will reopen on Saturday as Hoffman Estates Community Bank, a branch of Barrington Bank & Trust. FDIC insurance coverage up to the applicable limits will automatically cover depositors of Charter National. Over the weekend, customers of Charter National will have full access to their money through checking accounts, ATM or debit cards.

At December 31, 2011, Charter National Bank had total assets of $93.9 million and total deposits of $89.5 million.

Barrington Bank agreed to assume all deposits and purchase all assets of failed Charter National. The assets purchased by Barrington are protected from losses through a loss-share agreement with the FDIC that covers $72.1 million of the asset pool purchased.

In a press release issued by Wintrust Financial, CEO Edward Wehmer said the purchase of Charter National would increase earnings per share. Wintrust Financial has now completed eight acquisitions of failed banks over the past two years.

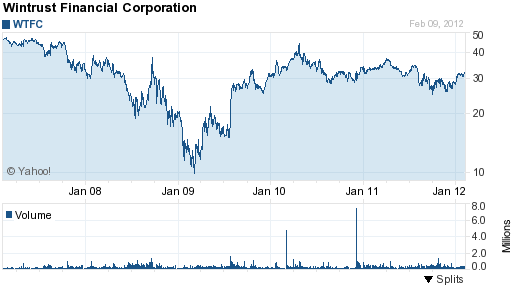

Wintrust Financial is well capitalized, has over $16 billion in assets and operates 15 wholly owned community bank subsidiaries with over 100 branch locations. Wintrust Financial is one of the few banks that has seen almost a complete recovery in its stock price since the financial meltdown of 2008.

The loss to the FDIC Deposit Insurance Fund for the failure of Charter National Bank and Turst is $17.4 million. Charter National becomes the nation’s eight banking failure of the year and the first in Illinois.

Speak Your Mind

You must be logged in to post a comment.