The first banking failure of 2012 occurred in Florida as regulators closed Central Florida State Bank, Belleview, Florida. During 2011, Florida had 13 banking failures, second only to Georgia which witnessed the closing of 23 banks. Combined, Florida and Georgia accounted for 39% of the 92 bank failures that occurred during 2011.

The first banking failure of 2012 occurred in Florida as regulators closed Central Florida State Bank, Belleview, Florida. During 2011, Florida had 13 banking failures, second only to Georgia which witnessed the closing of 23 banks. Combined, Florida and Georgia accounted for 39% of the 92 bank failures that occurred during 2011.

State regulators appointed the FDIC as receiver for the failed bank. To protect depositors, the FDIC sold Central Florida State Bank to CenterState Bank of Florida, N.A., Winter Haven, FL, which will assume all deposits of the failed bank.

Customers of failed Central Florida will have access to their money over the weekend through the use of checks, ATM and debit cards. The four branches of Central Florida State Bank will reopen on Monday as branches of CenterState Bank.

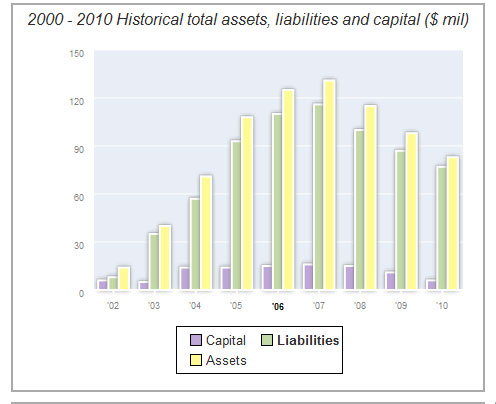

Central Florida State Bank was established at the dawn of the housing bubble on May 24, 2002. The bank rapidly expanded its assets in the booming Florida real estate market, growing from only $14 million in 2002 to $131 million at the peak in 2007.

Central Florida State Bank was a full service community bank which at the time of its closing had four branches locataed in Summerfield, Belleview, and Ocala in Marion County, Florida.

Central Florida was the subject of regulatory enforcement actions and had been issued a Consent Order in April 2011 which directed the Bank to cease unsafe and unsound banking practices. Unable to raise additional capital and faced with a massive amount of loan defaults, the failure of Central Florida State Bank became inevitable. At the time of closing, Central Florida Bank had a remarkably high troubled asset ratio of 480%. Historically, once a bank’s troubled asset ratio exceeds 100%, failure is almost certain.

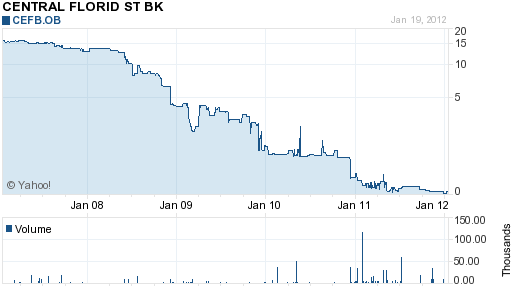

Shareholders in Central Florida State Bank have seen the value of their shares slide from the $15 range in 2007 to a closing price today of seven cents.

At September 30, 2011, Central Florida State Bank had total assets of $79.1 million and total deposits of $77.7 million. CenterState Bank agreed to purchase all of Central Florida’s assets, subject to a loss-share transaction with the FDIC on $53.6 million of the asset pool acquired. The FDIC maintains that keeping failed bank assets in the private sector minimizes losses and prevents disruptions to loan customers.

The closing of Central Florida State Bank will result in a loss of $24.4 million to the FDIC Deposit Insurance Fund. Central Florida State Bank is the first banking failures of 2012. The last banking failure in Florida occurred on December 16, 2011 with the failure of Premier Community Bank of the Emerald Coast.

Speak Your Mind

You must be logged in to post a comment.