Continuing scandals in the banking industry are making it difficult to avoid the conclusion that the entire crony capitalism structure of banking has become endemically corrupt. Even as the too big to fail banks vehemently lobby against new regulations under the Dodd-Frank Act, recent scandals at Barclays Plc and JP Morgan make it clear that […]

Ridiculous Divergence Between Bank CEO Pay And Shareholder Returns

The wide divergence between bank CEO compensation and shareholder returns is an embarrassment to the capitalist notion of linkage between performance and pay. Shareholders of banking stocks have seen the value of their investments pulverized over the past four years as the banking industry struggles to recover from the lending excesses of previous years. Shareholders […]

Credit Ratings of 15 Global Banks Cut In Largest Downgrades Since 2007

In the most sweeping credit downgrades since 2007, Moody’s Investor Service lowered the credit ratings of fifteen global banks, including the five largest banks in the United States. The scope of the credit downgrades left many wondering if we are entering a new phase of the global financial meltdown that started in 2008. Despite trillions […]

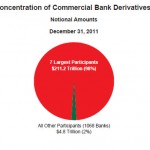

Banks Amass $211 Trillion In Derivatives, JP Morgan Loses $2 Billion And Volcher Rule Debates Continue

The goal of the Volcker Rule, which became law under the Dodd-Frank Act was to restrict speculative trading activity in risky derivatives by the Too Big To Fail Banks. The ban on proprietary bank trading was proposed by former Federal Reserve Chairman Paul Volcker who believed that one of the primary causes of the 2008 […]

Dallas Fed Says “Too Big To Fail Banks” Should Be Broken Up – Future “Severe Crises” Possible

The Federal Reserve Bank of Dallas joined the growing chorus of critics who maintain that the Dodd-Frank Act will not prevent future taxpayer funded bank bailouts. The Dallas Fed said taxpayers are still at risk for the cost of large banks failures and that any future bailouts should result in severe consequences for both bank […]

Bank Stress Tests Viewed As Fed Deception By Critics

Every banker knows that public confidence in the banking industry is essential. With the banking industry approaching a near meltdown last year, the Federal Reserve decided to conduct a series of “stress tests” on the country’s largest banks in order to restore confidence in the banking system. After reviewing the results of the stress tests, […]

What Big Bank Stock Has The Largest Price Gain In 2012?

After getting pounded during 2011, bank stocks have soared this year, especially after the Federal Reserve completed its “stress tests” and said that almost every big bank could survive “extremely adverse” economic conditions. During 2011 bank stock shareholders experienced the biggest price declines since the financial panic of 2008. As worries mounted over both the […]

Big Bank CEOs Take Home Massive Paychecks As Savers and Shareholders Get Crushed

Right or wrong, most consumers have an overwhelmingly negative opinion about big banks. According to a survey by Research and Markets, 86% of social media comments about U.S. and European banks are negative. The negative perception of big banks by the public has become so pervasive that most bank executives probably just ignore it at […]

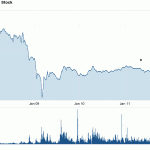

Bank Of America, Hated By Many, Could Make Some People Rich In 2012

During 2011, some of the smartest investment pros in the world bet heavily on Bank of America and lost big as the stock price collapsed. Concerns over the looming collapse of the European banking system sent U.S bank stocks into a tailspin as panicked investors sold. From a price of $15 in January 2011 the […]

Why Bank Stocks Are Impossible To Analyze or Value

During 2012, investor fears about the financial condition of banks resulted in the biggest decline in bank stocks since the financial crash of 2008. A weakening economy and fears about massive exposure to insolvent European financial institutions sent bank investors running to the exits. The brutal sell off in banking stocks during 2012 can be […]