The Consumer Financial Protection Bureau (CFPB) is concerned about the rapidly increasing default rate on mortgages held by senior citizens. A study done by the CFPB shows that the number of senior citizens with mortgage debt has increased, the amount of debt owed has increased, and default rates have risen. According to the CFPB since […]

Mortgage Default Rates Soar for Senior Citizens as Feds Loosen Mortgage Rules for Seniors

Staggering Debts Have Wrecked Our Economic Future

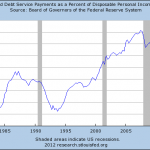

Bold actions by the Federal Reserve to smash interest rates to historically low levels were undertaken to reduce the burden of debt payments on consumers and businesses. The dramatic drop in interest rates since 2008, as well as a more cautious attitude towards debt by consumers, has resulted in lowering the household debt service ratio […]

FHA Reverse Mortgage Losses Of $28 Billion – Profits For Banks, Disaster For Borrowers and Taxpayers

Reverse mortgages have become the new minefield in government sponsored mortgage lending. According to an independent estimate done for HUD, losses could exceed $28 billion through 2019. To put that figure into perspective, total losses to the FDIC Deposit Insurance Fund for the 51 banking failures of 2012 total only $2.5 billion. The good news […]

FHA Loans Immediately Put Borrowers Into A Negative Equity Position

In a speech given at the Brookings Institution, Brian Moynihan, CEO at Bank of America, said “We need to look hard at some of the old assumptions and ask the question is homeownership the right solution for everyone?” Moynihan went on to cite the Federal Housing Administration (FHA) as an example of what is wrong […]

Connecticut Home Values Plunge As Banks Cut Jobs And Bonuses

Banking industry woes are translating into major price declines for high end residential real estate in Connecticut. For those who believe that real estate prices has bottomed out, please consider Connecticut Homes Biggest Losers As Wall Street Cuts. Prices in the Fairfield County area, home of the banker bedroom communities of Greenwich and New Canaan, […]

Americans Remain Remarkably Optimistic About Housing And Their Personal Finances

The latest Fannie Mae National Housing Survey shows that Americans remain remarkably optimistic about the future of the housing market as well as their personal financial situation. The Fannie Mae survey polls a nationally representative sample of 1,001 adults and compares the results to a previous poll conducted a year earlier. Home Prices The survey […]

Bank of America’s Stock Is A “Great Value” and Housing Will Come Back

It is always wise to pay attention to one of the greatest investment minds of all time. In the most recent letter to shareholders of Berkshire Hathaway, legendary investor Warren Buffet makes the case for a recovery of both the housing market and shares of Bank of America. Warren Buffet has shown time and again […]

Foreclosure Settlement Q&A – Who Wins, Who Loses – A Victory For The Irresponsible

A $25 billion foreclosure settlement reached between the government and the big banks has many wondering who will win and who will lose among the different parties involved. Although the settlement is complicated and will take years to work out, the basic framework will please some and annoy others. Here are some basic questions and […]

Interest Rates At All Time Lows And Home Prices At Ten Year Lows – Why Are Home Sales The Worst Ever?

In Federal Reserve Chairman Ben Bernanke’s world, all he had to do was lower interest rates enough and housing prices would magically re-inflate. Wrong! Mortgage rates are at all time lows, home prices are at 2002 levels and owning a home is just as cheap as renting, yet the housing market remains mired in a […]

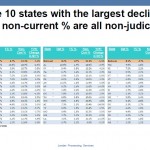

Foreclosure Inventory Near Record Highs, Attempts To Slow Foreclosures Is Prolonging The Housing Crisis

LPS Mortgage Monitor has come out with a comprehensive series of charts including the current level of foreclosures, delinquencies by year of origination, length of time homeowners have not made a payment in judicial states, states with largest drops in non-current mortgages and foreclosure rates in judicial vs non judicial states. The states with the […]