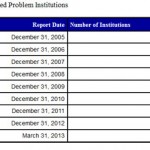

The latest Quarterly Banking Profile issued by the FDIC today shows almost a 10% decline in the number of banks on the confidential FDIC Problem Bank List. The number of problem banks finally declined to under 600 for the first time since the first quarter of 2009. The number of problem banks declined by 59 […]

FDIC Problem Bank List Includes Almost 9% of All Banks

The number of problem banks declined slightly during the first quarter of 2013. According to the latest Quarterly Banking Profile released today by the FDIC, the number of problem banks declined from 651 to 612, for a net reduction of 39 banks. Although profits for the overall banking industry have increased for the past 15 […]

Number of Banks on FDIC Problem Bank List Remains Historically High

The number of banks on the FDIC Problem Bank List declined for the seventh consecutive quarter. According to the latest FDIC Quarterly Banking Profile, the number of problem banks as of December 31, 2012, declined to 651 from 694 in the previous quarter. Despite significant recovery in the banking industry, the number of problem banks […]

2012 Bank Failures Lowest Since 2008 As Regulators Close 51 Banks

During the past five years we have witnessed the greatest financial turmoil since the Great Depression. Hundreds of giant bank failures rocked the nation, real estate values crashed, trillions of dollars of wealth vanished overnight and millions of Americans lost their jobs. Although a relative calm has been restored due to unprecedented actions by both […]

Bank Earnings Soar To Six Year High But Bank Stocks Still Off 50% From Pre Crisis Levels

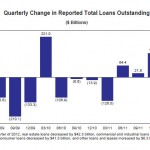

According to the latest FDIC Quarterly Banking Profile, the banking industry recorded its 13th consecutive quarterly year-over-year increase in profits. Total net income for all FDIC-insured institutions rose to $37.6 billion in the third quarter of 2012, a 6.6% increase from the third quarter of last year. Most of the increase in net earnings were […]

Doubts Remain Over Banking Industry “Recovery” – FDIC Quarterly Banking Profile

The banking industry, which was on the verge of collapse in 2008, is showing tenuous signs of recovery. The FDIC Quarterly Banking Profile for the quarter ending June 30, 2012, showed an increase in both bank profits and lending volume as well as a small decline in the number of problem banks. Almost 63% of […]

Higher Bank Profits Driven By Lower Loan Loss Provisions – Core Lending Business Declines

The earnings “recovery” in the banking industry continues to be driven by reduced loan loss provisions and higher fees rather than a fundamental improvement in the core lending business. The FDIC’s Quarterly Banking Profile for the first quarter of 2012 reports that aggregate quarterly profits of commercial banks and savings institutions increased for the 11th […]

Banking Industry Slowly Recovers – 813 Banks Remain On “Problem Bank List”

The FDIC’s Quarterly Banking Profile for the fourth quarter of 2011 shows a modest but steady recovery in the banking industry. Despite the fact that a majority of banks reported improved quarterly earnings, 813 institutions remain on the Problem Bank List, comprising 11% of all FDIC insured banks and savings associations. Highlights of the 2011 […]

Increase In Third Quarter Banking Profits Largely Due To Phony Accounting Gimmicks

The FDIC’s Quarterly Banking Profile for the third quarter of 2011 shows banking industry profits increasing by 48% from the third quarter of 2010. Aggregate net income of the banking industry for the third quarter of 2011 totaled $35.3 billion compared to $23.8 billion in the third quarter of 2010. Although traditional news organization headlines proclaimed “Strong Profit Growth […]

FDIC Reports Decline In Problem Banks But Banking Industry Remains In Intensive Care

The latest FDIC Quarterly Banking Profile shows a negligible decline in problem banks but the banking industry remains in intensive care. The banking industry reported a $28.8 billion profit for the second quarter which was $7.9 billion higher than last year’s quarter ending June 30, 2010. The bulk of the profit improvement, however, came from […]