In an unusual weekday action, state regulators closed Central Arizona Bank, Scottsdale, AZ, and appointed the FDIC as receiver. To protect depositors, the FDIC sold the failed bank to Western State Bank, Devils Lake, North Dakota, which will assume all deposits of Central Arizona Bank. With only $31.6 million in assets, the failure of Central […]

Central Arizona Bank Fails – Third Bank Failure In A Week For Capitol Bancorp, Ltd

Will the Failure of Pisgah Community Bank Trigger the Collapse of 10 Related Banks?

Bank failures don’t come much smaller than today’s closing of Pisgah Community Bank, Asheville, N.C. Total assets at Pisgah amounted to only $21.9 million, smaller than what many of the top executives take home in a year at the “too big to fail” banks. Pisgah Community Bank was established on May 15, 2008 on the […]

Number of Banks on FDIC Problem Bank List Remains Historically High

The number of banks on the FDIC Problem Bank List declined for the seventh consecutive quarter. According to the latest FDIC Quarterly Banking Profile, the number of problem banks as of December 31, 2012, declined to 651 from 694 in the previous quarter. Despite significant recovery in the banking industry, the number of problem banks […]

2012 Bank Failures Lowest Since 2008 As Regulators Close 51 Banks

During the past five years we have witnessed the greatest financial turmoil since the Great Depression. Hundreds of giant bank failures rocked the nation, real estate values crashed, trillions of dollars of wealth vanished overnight and millions of Americans lost their jobs. Although a relative calm has been restored due to unprecedented actions by both […]

Bank Earnings Soar To Six Year High But Bank Stocks Still Off 50% From Pre Crisis Levels

According to the latest FDIC Quarterly Banking Profile, the banking industry recorded its 13th consecutive quarterly year-over-year increase in profits. Total net income for all FDIC-insured institutions rose to $37.6 billion in the third quarter of 2012, a 6.6% increase from the third quarter of last year. Most of the increase in net earnings were […]

Citizens First National Bank, IL, Founded In 1865, Closed By Regulators

One of the country’s oldest banks, Citizens First National Bank, Princeton, IL, was closed today by the Comptroller of the Currency. The FDIC, acting as receiver, sold the failed bank to Heartland Bank and Trust Company, Bloomington, IL. Citizens First National, a large bank with 21 branches and almost $1 billion in assets, becomes the […]

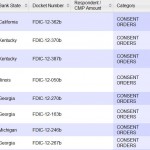

FDIC Issues 56 Enforcement Actions In July Against Banks and Individuals

The FDIC announced today that it took enforcement actions against a total of 56 banks and individuals during July 2012. During the previous month, the FDIC issued 48 enforcement actions. The July enforcement actions included 13 civil money penalties, 3 prompt corrective action notices, 5 consent orders, 8 section 19 orders, 12 removal and prohibition […]